Volume of transactions

Amount of deals

Clients

Countries

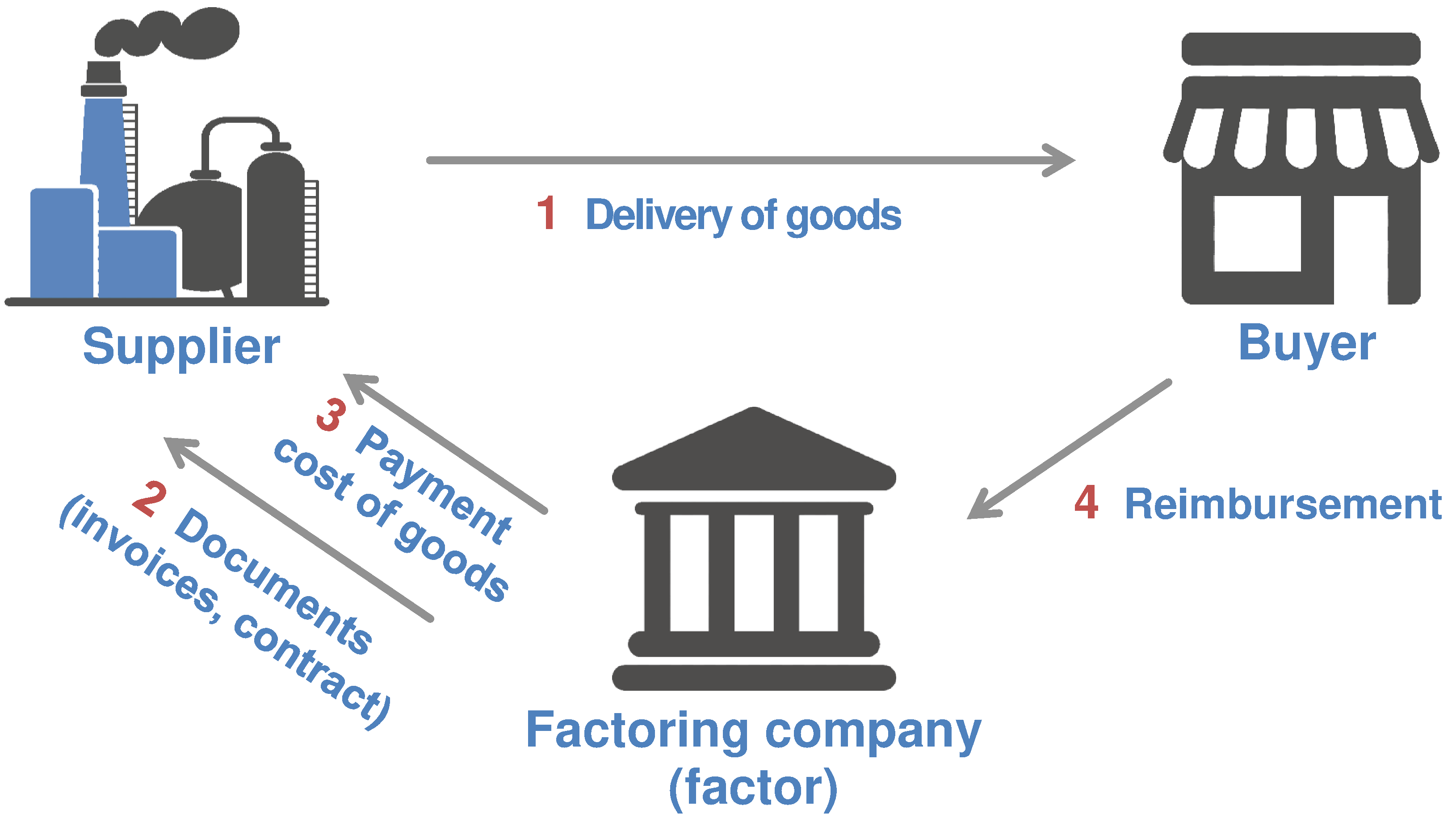

Factoring as one of the financial instruments involves the receipt of funds for the transaction from the agent, followed by payment of the debt by the buyer. Moreover, the seller himself pays a fee for the use of his services in favor of the factor. The contract may be both bilateral and trilateral, and may be for a fixed term or may be indefinite.

Often the factor simultaneously pays out about 90% of the value of the goods. The remaining amount comes after the buyer receives the goods and he will not have any claims to the product or make payment.

In case of force majeure, factoring services are especially needed: often enough, quickly increasing working capital is cheaper using different factoring schemes than using short-term bank loans.

becomes one of the attractive factors and is a competitive advantage, and the increase in the turnover of working capital of the company is achieved through factoring.

Factoring schemes are often used in transactions for the supply of goods and services from small firms to large corporations, chain stores. Large legal entities do not always show flexibility in working with smaller companies and are ready to cooperate on their own terms, offering only some standard agreement for small firms for the supply of goods and services.

1. Ability to conduct transactions without a deposit. All that is required from the consumer to get the goods is to pay from 10 to 30% of its value to the seller’s account. In the future, he returns to the financial agent the amount of money provided to him earlier: the remaining 70–90% plus interest for services (according to the terms of the service agreement concluded).

2. The opportunity for the seller to use the funds received from the agent in full. There is no need to save the cash balance on the account.

3. Warranties for the seller. Attracting a factoring company for a small commission, the supplier usually puts on him not only the obligations to receive money from the borrower, but also frees himself from having to pay income tax from his own funds; The latter often happens when the seller has already delivered the goods to the buyer, but he does not have time to transfer the required amount of money to the creditor’s account before the deadline for the payment of tax.

4. Maintain a neutral internal balance. Factoring services do not affect the credit history of both the company and the individual entrepreneur, because factoring services are not related to lending.

5. Due to the formation of a more profitable offer, as a result of the payment installments provided, the possibility of attracting new customers appears.

1. It is impossible to keep a trade secret. Not a single company providing factoring services will provide borrowed funds until they are sure of the full reliability of the borrower. And for this, the lender will have to provide the factoring company with all the information about the client.

2. Narrow focus. Factoring can be used in the conclusion of any transactions aimed at making a profit, but it is mainly used in the supply of goods and services that are paid by bank transfer.

In the course of a transaction, the bank or factoring company constantly monitors the debtor’s activities. Both the actual fulfillment of the terms of the transaction and the buyer's compliance with the requirements of the factor are analyzed. If the fact of asset withdrawal is noted or signs of bankruptcy appear, the factoring agreement may be terminated, and the factor will require the immediate payment of receivables.

The same applies to breach of obligations by the parties to the transaction: the factor may make claims both to the seller, with whom the bank has a direct factoring service agreement, and to the buyer, who as a result of the transaction became a debtor of the factor.

Also, the client and its partner buyers are revalued on an ongoing basis.

1. With an urgent need to attract borrowed working capital.

Small business, which often lack favorable credit offers, has a large tax burden and is in dire need of using this financial instrument.

2. The main task is to attract new and retain loyal customers. It is more convenient for many consumers, especially in the difficult economic situation, to receive goods by installments, initially making a small part of its value. Factoring allows the seller not to risk their financial resources and not to spend extra time on communication with creditors.

3. The situation of unreliability of one of the parties. It is difficult to say whether a factor agrees to provide money under such circumstances, but, having found a suitable financial agent, the seller, without burdening himself with the conclusion of an assignment agreement, shifts the money from the consumer to him.

4. The discrepancy between the activities of counterparties. When a small enterprise supplies goods to a large industrial company or, on the contrary, buys from it any products, most likely, their payment schedules do not match. Factoring will eliminate this inconvenience by leveling the time lag: the lender will receive payment for the goods immediately and in full, and the consumer can pay for the delivery of goods without urgent withdrawal of working capital.

1. Shorter terms of repayment of debt, as a rule, up to 12 months from the moment of its occurrence.

2. The borrower is not required to provide collateral.

3. The amount of funds provided is not fixed: it is determined by the supplier.

4. A contract with a factor can be concluded on a perpetual basis: the seller will receive the required amount each time upon submission of invoices — without re-issuing documents.

5. Debt is not repaid by the recipient of money, but by a third party — the consumer.

Factoring — ease of processing commercial relations and comfortable payment conditions for the client.

Liviera Investments Limited use many financial instruments to help you to achieve your economic goals.

We issue the following financial instruments:

LC — Letter of Credit

LC — Letter of Credit

DLC — Documentary Letter of Credit

DLC — Documentary Letter of Credit

SBLC — Standby Letter of Credit

SBLC — Standby Letter of Credit

BG — Bank Guarantee

BG — Bank Guarantee

LG — Letter of Guarantee

LG — Letter of Guarantee

POF — Proof of Funds

POF — Proof of Funds

POA — Proof of Assets

POA — Proof of Assets

POP — Proof of Product

POP — Proof of Product

Additional service:

Services in the SWIFT system

Services in the SWIFT system

Trade finance

Trade finance

Factoring

Factoring

Financial consulting

Financial consulting

Trade consulting

Trade consulting

IT consulting

IT consulting

Packing credit

Packing credit

Funding

Funding

Monetization

Monetization

We very actively work with the following countries:

China, India, United Arab Emirates, Indonesia, Malaysia, Greece, United States of America, Canada, Nigeria, Singapore, Uzbekistan, Kazakhstan, Afghanistan, Ukraine, Georgia, Romania, Ghana, South Africa, Turkey and other countries.

Our team promotes your goals and helps you achieve high results.

We, Liviera Investments Limited, are interested in your pursuit of a prosperous business and we are doing our best to make your efforts a success.

Our team will apply the maximum knowledge and experience so that your company develops and functions harmoniously. We are fundamentally different from other companies, because we know how to correctly use financial instruments to achieve your high results: a lot of our own running and functioning projects made it possible to study the process of successful business operation.

Philosophy

Our experts are well aware that any business consists of a huge number of nuances that need to be taken into account and approach every task thoroughly. Success guidelines do not exist, and our experts with professional skills will help you to achieve success soon. We find innovative solutions that we offer at your service!

Expert knowledge

We know that any business is accompanied by various difficulties, but we are here to help you every step of the way. Our specialists have gone through similar professional situations and can assist you in building an effective business process. We have a wealth of experience and knowledge and are experts in our work!

Our network:

Great Britain, France, Germany, Russia, China, New Zealand, India, United Arab Emirates, Indonesia, Malaysia, Greece, USA, Canada, Singapore, Belgium, Uzbekistan, Kazakhstan, Afghanistan, Ukraine, Georgia, Romania, Ghana, South Africa, Turkey, Slovakia , Bulgaria, Hungary.

Liviera Investments Limited is your financial partner for all your trade finance projects.