Volume of transactions

Amount of deals

Clients

Countries

The abbreviation SWIFT stands for Society for Worldwide Interbank Financial Telecommunications. The main goal is to transfer information and make payments in an international format.

The abbreviation SWIFT stands for Society for Worldwide Interbank Financial Telecommunications. The main goal is to transfer information and make payments in an international format.

The main reasons of creating the SWIFT system appeared immediately after World War II, in the early 50s of the 20th century. During these times, active recovery of states continued, which began to vigorously engage in international trade with neighboring countries. This led to a sharp increase in banking functions and operations.

Communication between banks was carried out using mail and telegraph, but such methods of information transmission became ineffective due to the rapid increase in the volume of banking operations and the need to reduce the time spent on them. Also, more and more conflicts and mistakes began to arise during interbank transactions related to various requirements in the functioning of banks, there were no uniform standards for the exchange of information in the banking sector.

We provide assistance with connecting to the work of the SWIFT system, conduct individual consultations on how to make payments using this system, and provide services in lobbying the interests of our partners in receiving various types of swift messages from a number of banks. We have enough knowledge and capabilities to contribute to your continued financial growth, stability and prosperity.

SWIFT transfer was initially functioning between 240 banks in 16 countries. But a few months after its creation, about 1,500 financial institutions joined it.

At the same time, to make money transfers you need to know the special SWIFT code of the bank and its name. Individuals, organizations, exchanges, depositories, brokers use the system to transfer money in the chosen currency, in comfortable conditions and with a minimum commission, as well as to exchange information. The main thing that attracts members of the cooperative is the high security of transactions. Also, with the SWIFT system many bureaucratic problems can be avoided. There is a global network in front of customers without extensive government restrictions or other obstacles. The algorithm of this system has endured many changes and complications, especially after the September 11 attacks in the United States. To avoid the possibility of sponsoring various terrorist organizations around the world, the system is constantly being improved day by day.

Incredible scale dissemination of SWIFT in the world allows you to transfer to the client by any well-known bank, the amount is limited only by the maximum values allowed in this economic legislation.

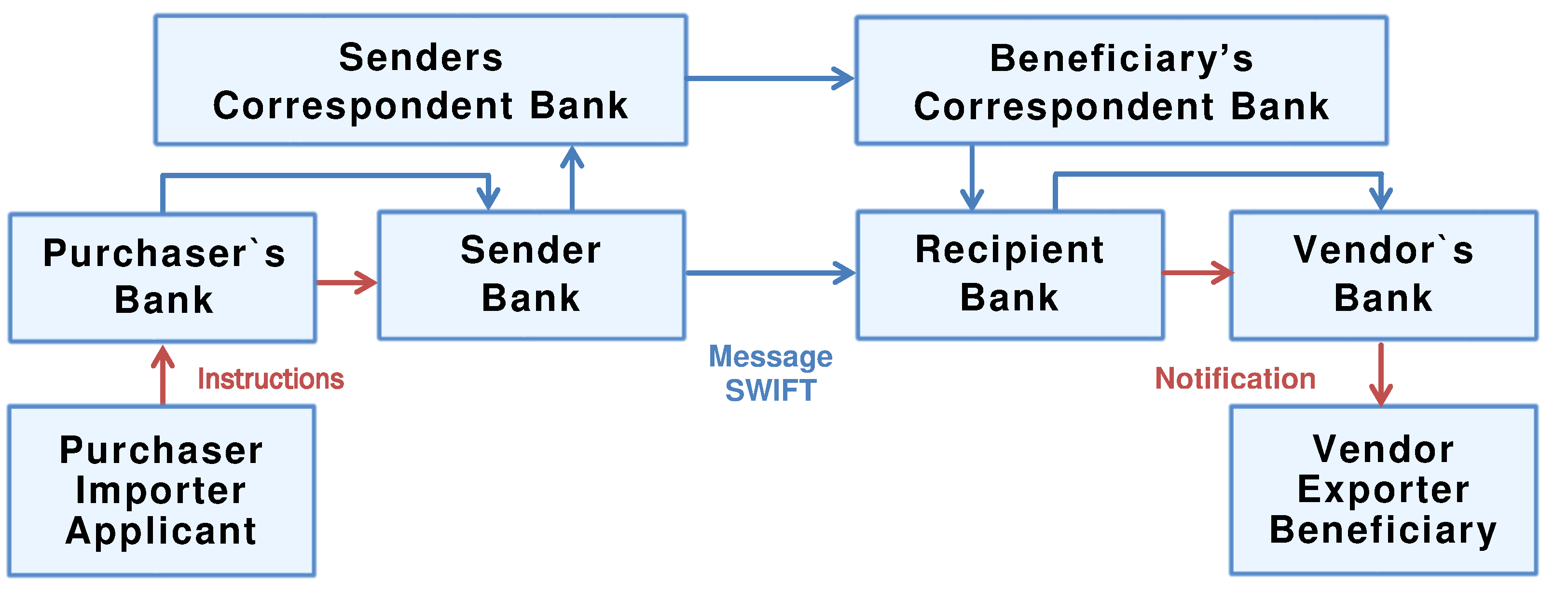

When a bank needs to confirm a transaction or make a payment to another financial institution, it forms a message with the specified information and sends it in a form encrypted with the SWIFT system using a special terminal. A special computer terminal allows instant communication with a remote computer to send and receive such messages. All data is then accumulated in the regional server and redirected to the operations center, where the information is called a unique number, processed and sent to the target system participants, if only the messages have passed the test with a positive result. Otherwise, the message will not pass.

One transaction can take up to a week. But when using correspondent accounts of the largest transnational banks, the period is usually not more than one day. More information about the timing for a particular bank you can consult with us.

SWIFT transfers are characterized by high accuracy of cash delivery, as the purpose of the transfer indicates in detail the country, region, branch of the beneficiary bank, currency. Directly an individual is determined by an individual account or passport data. At the same time, all information is encrypted, which provides customers with additional benefits: absolute confidentiality and security. The delivery time of the message, and therefore the money, is carried out from one day to one week, and is almost never broken, provided that all details were correctly specified.

The charter of the organization is executed according to the Belgian legislation one of the most democratic in the world, the main office is located in the capital of Belgium the city of Brussels. Using our offer, you can quickly and easily send money in any currency to the accounts of legal entities and individuals anywhere in the world with a minimum commission.

The use of the international SWIFT system has its indisputable advantages.

The advantages of SWIFT transfers include:

1. Ensuring a high level of security when transferring funds between states.

2. High-speed processing of client orders.

3. A wide range of amounts that can be transferred between countries.

4. Accessibility of payments in any type of currency.

5. The minimum cost of services.

6. Receipt of transfers in almost every corner of the planet wherever there are banks.

7. Financial protection implies full compensation for damages if a system failure occurs during a transaction.

When using a SWIFT system, there may be negative aspects. In some cases, the transfer takes a long time, up to 5-7 days. In addition, due to the involvement of several participating banks in the process, some inaccuracy may arise. Our experts will help you to avoid any mistakes and losses associated with making various financial transactions in the SWIFT system. Our company is the guarantor of a successful transaction, timely fulfilled financial obligations. We work accurately and on time! Our experts will professionally assist and advise you on the issues you have.

Liviera Investments Limited use many financial instruments to help you to achieve your economic goals.

We issue the following financial instruments:

LC — Letter of Credit

LC — Letter of Credit

DLC — Documentary Letter of Credit

DLC — Documentary Letter of Credit

SBLC — Standby Letter of Credit

SBLC — Standby Letter of Credit

BG — Bank Guarantee

BG — Bank Guarantee

LG — Letter of Guarantee

LG — Letter of Guarantee

POF — Proof of Funds

POF — Proof of Funds

POA — Proof of Assets

POA — Proof of Assets

POP — Proof of Product

POP — Proof of Product

Additional service:

Services in the SWIFT system

Services in the SWIFT system

Trade finance

Trade finance

Factoring

Factoring

Financial consulting

Financial consulting

Trade consulting

Trade consulting

IT consulting

IT consulting

Packing credit

Packing credit

Funding

Funding

Monetization

Monetization

We very actively work with the following countries:

China, India, United Arab Emirates, Indonesia, Malaysia, Greece, United States of America, Canada, Nigeria, Singapore, Uzbekistan, Kazakhstan, Afghanistan, Ukraine, Georgia, Romania, Ghana, South Africa, Turkey and other countries.

Our team promotes your goals and helps you achieve high results.

We, Liviera Investments Limited, are interested in your pursuit of a prosperous business and we are doing our best to make your efforts a success.

Our team will apply the maximum knowledge and experience so that your company develops and functions harmoniously. We are fundamentally different from other companies, because we know how to correctly use financial instruments to achieve your high results: a lot of our own running and functioning projects made it possible to study the process of successful business operation.

Philosophy

Our experts are well aware that any business consists of a huge number of nuances that need to be taken into account and approach every task thoroughly. Success guidelines do not exist, and our experts with professional skills will help you to achieve success soon. We find innovative solutions that we offer at your service!

Expert knowledge

We know that any business is accompanied by various difficulties, but we are here to help you every step of the way. Our specialists have gone through similar professional situations and can assist you in building an effective business process. We have a wealth of experience and knowledge and are experts in our work!

Our network:

Great Britain, France, Germany, Russia, China, New Zealand, India, United Arab Emirates, Indonesia, Malaysia, Greece, USA, Canada, Singapore, Belgium, Uzbekistan, Kazakhstan, Afghanistan, Ukraine, Georgia, Romania, Ghana, South Africa, Turkey, Slovakia , Bulgaria, Hungary.

Liviera Investments Limited is your financial partner for all your trade finance projects.