Volume of transactions

Amount of deals

Clients

Countries

Factoring is one of the few financial tools for business development that is becoming increasingly popular in the business environment. Factoring is an excellent alternative to traditional sources of business financing, such as bank loans. It is a comprehensive service that involves secured financing of the working capital of a business.

A remarkable feature of this financial instrument is that it is useful for its accessibility and ease of use. After all, everyone knows how difficult it is to get a loan to develop your own business. It is especially difficult to get a loan now — banks often tighten requirements, and, without that, it becomes almost impossible to get an unfavorable loan!

1. The rapid attraction of fresh financial resources to the work of the company, which are released as a result without pledge to replenish working capital and cover cash gaps.

2. As a result of the rapid addition to the work of cash — guaranteed growth in sales, including due to the possibility of deferred payment. These conditions help to attract more and more new customers. It should be noted that the company using this financial instrument has no limits on financing against the assignment of a monetary claim.

Using factoring services, the company ensures itself a smoothly running work, and, as a result, ensures a guaranteed growth in sales volumes, while not being distracted by the endless settlement of issues related to receivables management. This fact is the main goal when contacting us and choosing factoring.

• to make a decision on factoring a company needs a minimum set of documents, and the approach to financing is not a bank at all.

• in the process of factoring, not only the current state of the company is assessed, but also its future potential. Sometimes even the most experienced company executives are not aware of their potential. The decision on the acceptance of the applied company for factoring is made fairly quickly. The factoring decision is made faster than when issuing traditional bank loans for the development of the company's business.

• the most important indisputable advantage of factoring over other types of loans is the set of measures for managing the company's receivables.

A part of the financing invoices for the assignment of a monetary claim is transferred to us. Thus, all the processes for managing receivables of an enterprise are passed on to us. We, in turn, take on factoring service seller.

We also undertake all management processes, that is, acceleration of payments, elimination of delays or non-payment. Factoring is great for small and medium businesses, especially for those companies that work with a deferred payment. Suppliers of large networks can serve as an excellent example. The network shop undertakes to pay only within one or two months after shipment. And using factoring, the supplier company will receive payment immediately after shipment.

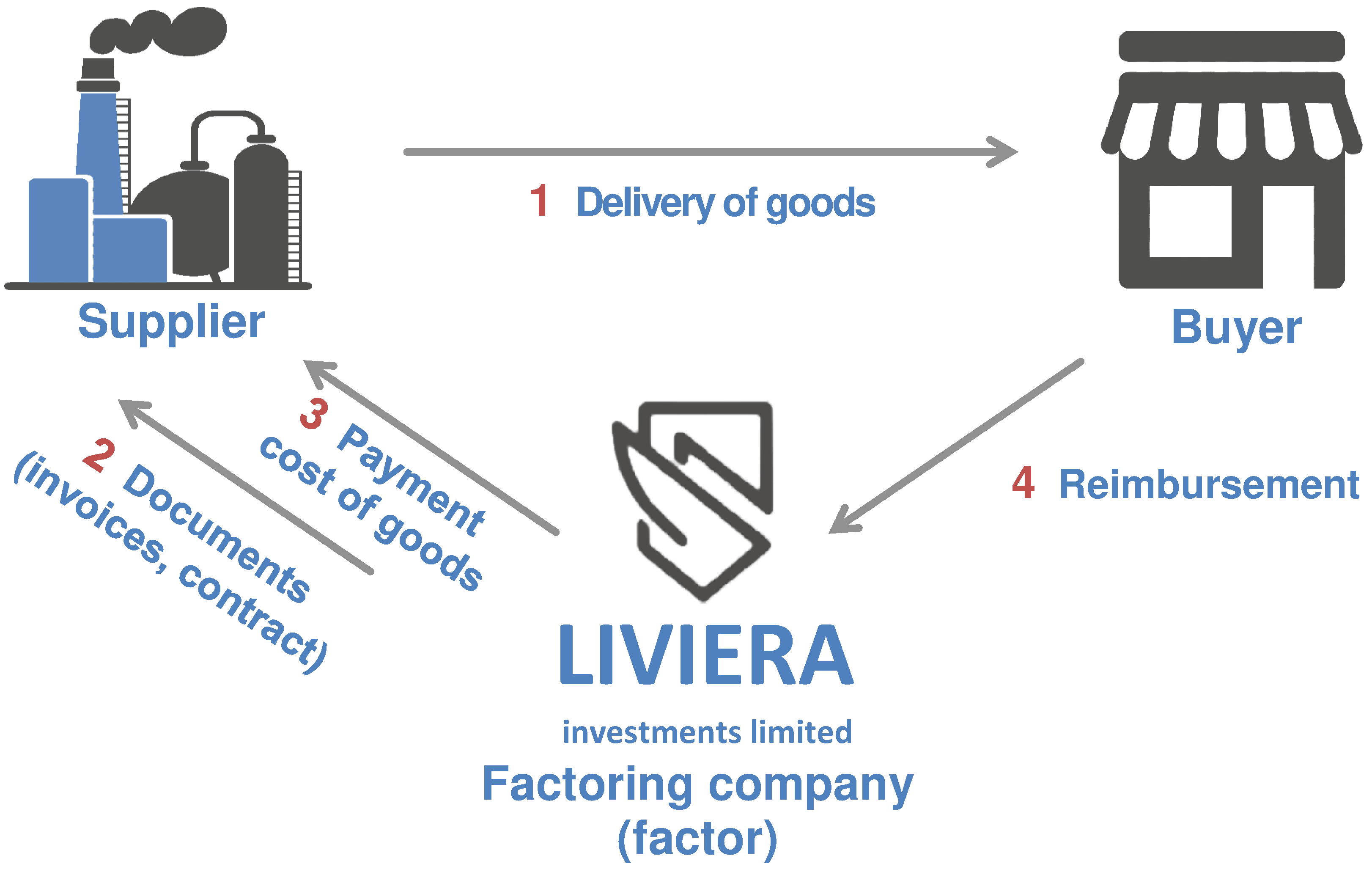

The supplier with our company enters into a contract and he notifies the buyer of its availability. The additional agreement signed by the buyer and the seller reflects the order of shipment and payment. The next step is to ship the goods to the buyer's warehouse. The supplier sends the purchase documents to our company, we transfer the money to the supplier’s account (partial payments are possible if necessary). The buyer pays with us, and we transfer the remaining funds to the supplier (minus the commission). So the supplier does not expect long payment from the buyer, but receives it immediately. For this, he pays the bank a commission (less than 10% of the amount). Several factors may be involved in a single transaction.

We want to draw attention to the important point that in preparing for the signing of the contract, our company has the right to ascertain the reliability of the parties: the seller, who takes on the role of the lender and financial guarantor, and the buyer at the same time. The easiest way to do this is to request documents about the rules of delivery and payment, as well as about earlier cases of late payments and unpaid bank accounts of the buyer.

We note the main advantages for the buyer:

• Making a purchase with a deferred payment

• The ability to pay directly to the bank (usually a credit institution provides several options for payment)

• It is not required to switch to settlement and cash services at the bank

• The size of the transaction is not limited, depending on the volume of sales

• Indefinite action or until the date of termination of the contract between the supplier and the bank

• The possibility of partial payment

Supplier Benefits:

• Guaranteed accelerated receipt of money

• Possible increase in turnover rate

• Covering the main risks by the bank (in case of a delay in payment, instability of exchange rates, as well as lack of liquidity, and so on)

• No collateral required (as opposed to a conventional bank loan)

Advantages for us:

• Remuneration for the operation

• The expansion of the customer base

There are also disadvantages in factoring:

• You must pay for the service and the amount of payment depends on the size of the transaction

We are working to make you feel comfortable working with us!

Liviera Investments Limited use many financial instruments to help you to achieve your economic goals.

We issue the following financial instruments:

LC — Letter of Credit

LC — Letter of Credit

DLC — Documentary Letter of Credit

DLC — Documentary Letter of Credit

SBLC — Standby Letter of Credit

SBLC — Standby Letter of Credit

BG — Bank Guarantee

BG — Bank Guarantee

LG — Letter of Guarantee

LG — Letter of Guarantee

POF — Proof of Funds

POF — Proof of Funds

POA — Proof of Assets

POA — Proof of Assets

POP — Proof of Product

POP — Proof of Product

Additional service:

Services in the SWIFT system

Services in the SWIFT system

Trade finance

Trade finance

Factoring

Factoring

Financial consulting

Financial consulting

Trade consulting

Trade consulting

IT consulting

IT consulting

Packing credit

Packing credit

Funding

Funding

Monetization

Monetization

We very actively work with the following countries:

China, India, United Arab Emirates, Indonesia, Malaysia, Greece, United States of America, Canada, Nigeria, Singapore, Uzbekistan, Kazakhstan, Afghanistan, Ukraine, Georgia, Romania, Ghana, South Africa, Turkey and other countries.

Our team promotes your goals and helps you achieve high results.

We, Liviera Investments Limited, are interested in your pursuit of a prosperous business and we are doing our best to make your efforts a success.

Our team will apply the maximum knowledge and experience so that your company develops and functions harmoniously. We are fundamentally different from other companies, because we know how to correctly use financial instruments to achieve your high results: a lot of our own running and functioning projects made it possible to study the process of successful business operation.

Philosophy

Our experts are well aware that any business consists of a huge number of nuances that need to be taken into account and approach every task thoroughly. Success guidelines do not exist, and our experts with professional skills will help you to achieve success soon. We find innovative solutions that we offer at your service!

Expert knowledge

We know that any business is accompanied by various difficulties, but we are here to help you every step of the way. Our specialists have gone through similar professional situations and can assist you in building an effective business process. We have a wealth of experience and knowledge and are experts in our work!

Our network:

Great Britain, France, Germany, Russia, China, New Zealand, India, United Arab Emirates, Indonesia, Malaysia, Greece, USA, Canada, Singapore, Belgium, Uzbekistan, Kazakhstan, Afghanistan, Ukraine, Georgia, Romania, Ghana, South Africa, Turkey, Slovakia , Bulgaria, Hungary.

Liviera Investments Limited is your financial partner for all your trade finance projects.