Volume of transactions

Amount of deals

Clients

Countries

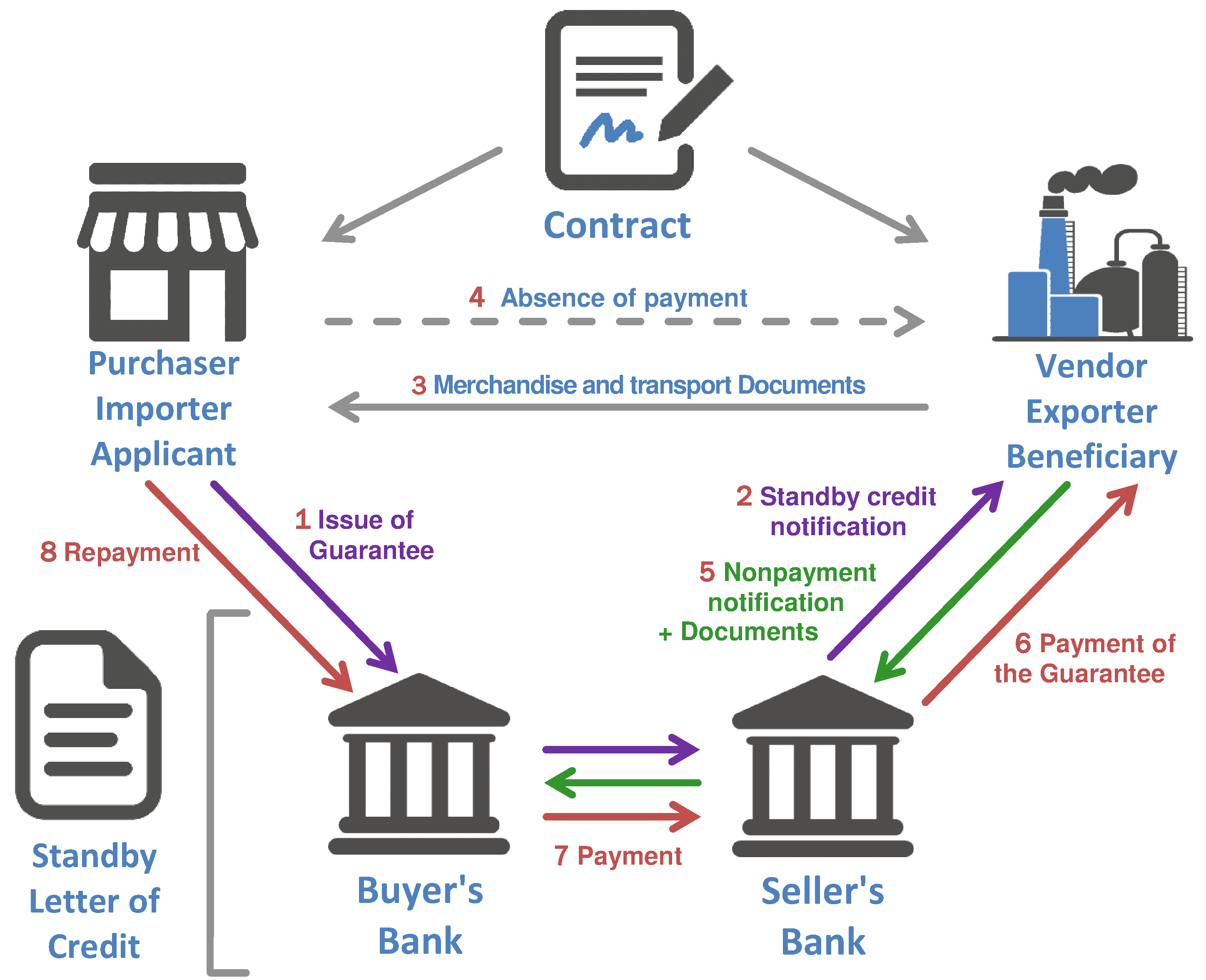

A Standby Letter of Credit — this is a special type of letter of credit, is an obligation of a credit institution (bank) to the supplier to pay for the buyer, when the latter has not fulfilled the terms of the contract.

We would like to draw your attention to the fact that if the payer has paid for the delivered products and the supplier has shipped them, then there is no need to use a standby letter of credit.

A standby letter of credit is required if one of the partners violates the terms of the contract.

For example, if the payer did not pay for the delivered goods, the supplier submits an application to the bank about non-receipt of payments and attaches to the application all copies of documents testifying of the shipment of the goods. In this case, the issuing bank is already obliged to make settlements with the supplier, even if the payer does not agree. Therefore, the standby letter of credit provides for an unconditional payment on it. After that, the payer is obliged to pay the bank for the payment made.

1. A letter of credit is used in the event that the payer fails to fulfill its financial obligations to the supplier.

2. Standby letter of credit can be attributed to the additional security for both the exporter and the importer. If the payer violates the terms of the contract, the Exporter will receive payment for the goods or the service rendered, and the Importer will be able to return the advance payment if it was provided for.

3. Standby letter of credit operates outside the framework of the national legislation of countries, and this speaks of its reliability and safety.

fast, flexible, simple and affordable

fast, flexible, simple and affordable

guarantees the supplier payment for goods and services in full

guarantees the supplier payment for goods and services in full

valid for the entire duration of the contract

valid for the entire duration of the contract

is subject to international law governing the letter of credit — UCP. Banks send a Stand-by Letter of Credit through SWIFT MT799 and then SWIFT MT760.

is subject to international law governing the letter of credit — UCP. Banks send a Stand-by Letter of Credit through SWIFT MT799 and then SWIFT MT760.

Contact us and you can save significant time and financial resources. We will provide you with financial peace of mind when concluding a deal with a supplier!

You can leave a request on our website.

Liviera Investments Limited use many financial instruments to help you to achieve your economic goals.

We issue the following financial instruments:

LC — Letter of Credit

LC — Letter of Credit

DLC — Documentary Letter of Credit

DLC — Documentary Letter of Credit

SBLC — Standby Letter of Credit

SBLC — Standby Letter of Credit

BG — Bank Guarantee

BG — Bank Guarantee

LG — Letter of Guarantee

LG — Letter of Guarantee

POF — Proof of Funds

POF — Proof of Funds

POA — Proof of Assets

POA — Proof of Assets

POP — Proof of Product

POP — Proof of Product

Additional service:

Services in the SWIFT system

Services in the SWIFT system

Trade finance

Trade finance

Factoring

Factoring

Financial consulting

Financial consulting

Trade consulting

Trade consulting

IT consulting

IT consulting

Packing credit

Packing credit

Funding

Funding

Monetization

Monetization

We very actively work with the following countries:

China, India, United Arab Emirates, Indonesia, Malaysia, Greece, United States of America, Canada, Nigeria, Singapore, Uzbekistan, Kazakhstan, Afghanistan, Ukraine, Georgia, Romania, Ghana, South Africa, Turkey and other countries.

Our team promotes your goals and helps you achieve high results.

We, Liviera Investments Limited, are interested in your pursuit of a prosperous business and we are doing our best to make your efforts a success.

Our team will apply the maximum knowledge and experience so that your company develops and functions harmoniously. We are fundamentally different from other companies, because we know how to correctly use financial instruments to achieve your high results: a lot of our own running and functioning projects made it possible to study the process of successful business operation.

Philosophy

Our experts are well aware that any business consists of a huge number of nuances that need to be taken into account and approach every task thoroughly. Success guidelines do not exist, and our experts with professional skills will help you to achieve success soon. We find innovative solutions that we offer at your service!

Expert knowledge

We know that any business is accompanied by various difficulties, but we are here to help you every step of the way. Our specialists have gone through similar professional situations and can assist you in building an effective business process. We have a wealth of experience and knowledge and are experts in our work!

Our network:

Great Britain, France, Germany, Russia, China, New Zealand, India, United Arab Emirates, Indonesia, Malaysia, Greece, USA, Canada, Singapore, Belgium, Uzbekistan, Kazakhstan, Afghanistan, Ukraine, Georgia, Romania, Ghana, South Africa, Turkey, Slovakia , Bulgaria, Hungary.

Liviera Investments Limited is your financial partner for all your trade finance projects.