Volume of transactions

Amount of deals

Clients

Countries

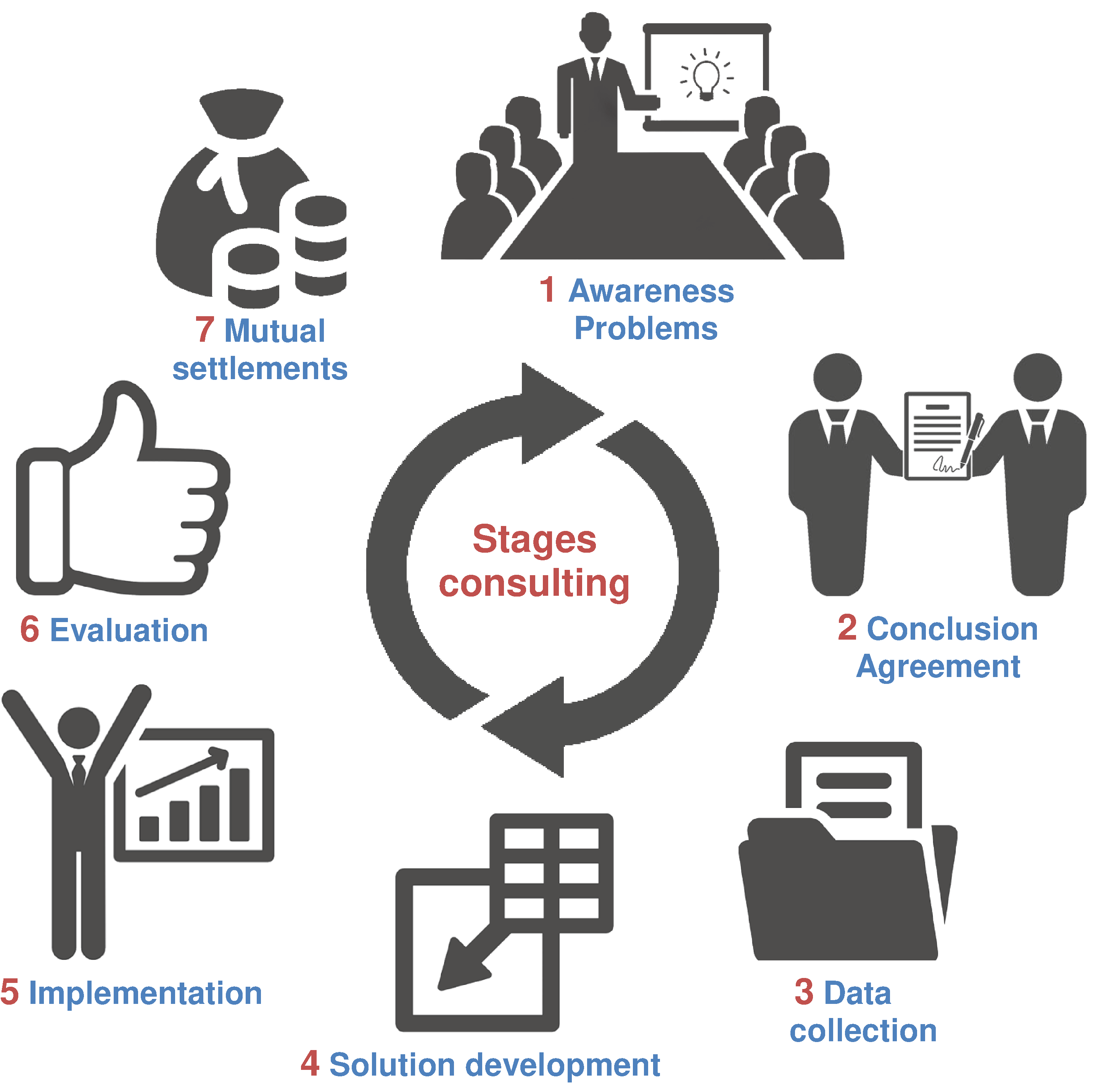

Financial consulting will help to combine all the knowledge and experience of a particular company with extensive experience gained in international practice. Due to this, our client can get the best solutions for their company, taking into account the specifics of its activities. It is the combination of specifics and generalization that gives financial consulting significant advantages over the classical scheme of internal enterprise management.

Financial consulting will help to combine all the knowledge and experience of a particular company with extensive experience gained in international practice. Due to this, our client can get the best solutions for their company, taking into account the specifics of its activities. It is the combination of specifics and generalization that gives financial consulting significant advantages over the classical scheme of internal enterprise management.

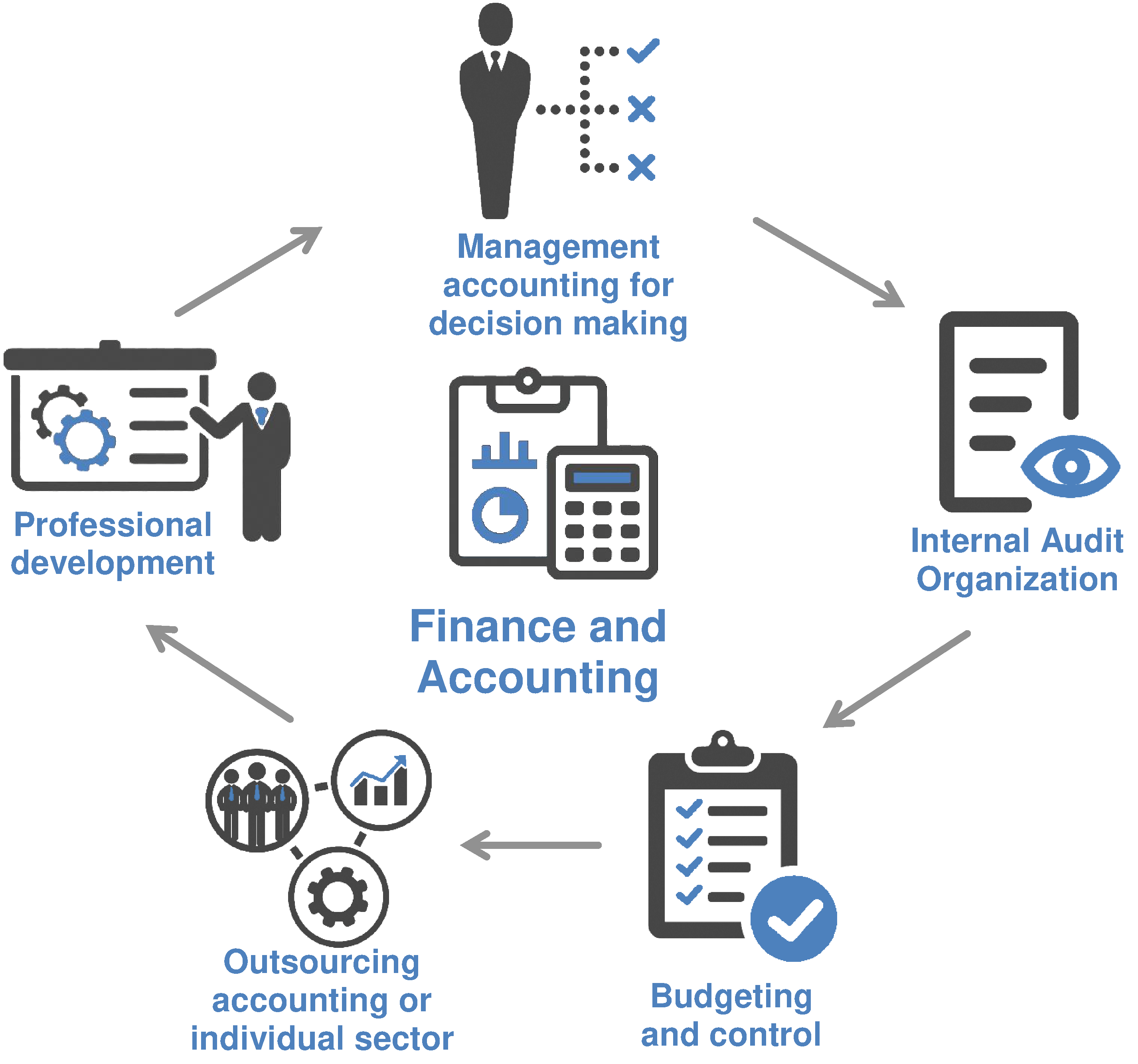

is a competent qualified assistance to the head of the company in improving the financial performance of the company. As part of financial consulting services, our specialists can provide one-time consultations (for example, the current state of affairs and optimization of the company's resources) as well as develop a full-scale long-term development strategy for the company. Financial consulting services also "work" on the prospects of the enterprise, the expansion of the business and the increase in the company's profits.

a) If we talk about the analysis of the financial and economic condition of the company, we need to say that it is the very first stage on the way to raising capital. The stage of the analysis of the company's activity consists in a complete and detailed assessment of the current financial and economic activities of the company, its projected indicators and financial ratios. The result of this procedure is to determine the financial condition of the company, the volume of funds raised in the external financial market and the degree of investment attractiveness.

b) Investors are interested in evaluating the company's activities and its investment opportunities, as well as the real value of the company's shares. The management of the company needs to periodically assess the value of the company and monitor the dynamics of its change. This procedure for assessing the business and investment opportunities of a company is often advisable in the event of a merger or acquisition of the company, determining its level of creditworthiness.

c) Companies that are planning to raise additional capital should choose the most rational and optimal ways of borrowing. In this case, Financial Modeling is the next and equally important stage on the road to improving the financial situation in the future. Our specialists will develop and substantiate various options for the development of the company's financial situation in the future, while taking into account all the features of the national market, the competition characteristic of the industry, as well as the technological and personnel potential of the company.

d) The development of the company's financial strategy is the final preparatory stage, which precedes the final choice of the role of the future investor, as well as the ways of financing. The client company is given the opportunity to choose the most optimal direction for the development of the company's activities in the future, such as its financing, as well as the most acceptable financial solution from the point of view of solving its strategic tasks.

We offer to use our financial consulting services. To do this leave a request on our website, and you can get more detailed advice from a representative of our company.

Liviera Investments Limited use many financial instruments to help you to achieve your economic goals.

We issue the following financial instruments:

LC — Letter of Credit

LC — Letter of Credit

DLC — Documentary Letter of Credit

DLC — Documentary Letter of Credit

SBLC — Standby Letter of Credit

SBLC — Standby Letter of Credit

BG — Bank Guarantee

BG — Bank Guarantee

LG — Letter of Guarantee

LG — Letter of Guarantee

POF — Proof of Funds

POF — Proof of Funds

POA — Proof of Assets

POA — Proof of Assets

POP — Proof of Product

POP — Proof of Product

Additional service:

Services in the SWIFT system

Services in the SWIFT system

Trade finance

Trade finance

Factoring

Factoring

Financial consulting

Financial consulting

Trade consulting

Trade consulting

IT consulting

IT consulting

Packing credit

Packing credit

Funding

Funding

Monetization

Monetization

We very actively work with the following countries:

China, India, United Arab Emirates, Indonesia, Malaysia, Greece, United States of America, Canada, Nigeria, Singapore, Uzbekistan, Kazakhstan, Afghanistan, Ukraine, Georgia, Romania, Ghana, South Africa, Turkey and other countries.

Our team promotes your goals and helps you achieve high results.

We, Liviera Investments Limited, are interested in your pursuit of a prosperous business and we are doing our best to make your efforts a success.

Our team will apply the maximum knowledge and experience so that your company develops and functions harmoniously. We are fundamentally different from other companies, because we know how to correctly use financial instruments to achieve your high results: a lot of our own running and functioning projects made it possible to study the process of successful business operation.

Philosophy

Our experts are well aware that any business consists of a huge number of nuances that need to be taken into account and approach every task thoroughly. Success guidelines do not exist, and our experts with professional skills will help you to achieve success soon. We find innovative solutions that we offer at your service!

Expert knowledge

We know that any business is accompanied by various difficulties, but we are here to help you every step of the way. Our specialists have gone through similar professional situations and can assist you in building an effective business process. We have a wealth of experience and knowledge and are experts in our work!

Our network:

Great Britain, France, Germany, Russia, China, New Zealand, India, United Arab Emirates, Indonesia, Malaysia, Greece, USA, Canada, Singapore, Belgium, Uzbekistan, Kazakhstan, Afghanistan, Ukraine, Georgia, Romania, Ghana, South Africa, Turkey, Slovakia , Bulgaria, Hungary.

Liviera Investments Limited is your financial partner for all your trade finance projects.