Volume of transactions

Amount of deals

Clients

Countries

A letter of credit is the most secure form of payment, which ensures 100% fulfillment by the seller and the buyer of their obligations under the contract of sale. Letter of credit is a contingent liabilities assumed by the bank on behalf of the buyer to make a payment in favor of the seller (beneficiary) specified in the letter of credit amounts upon the latter submitting documents to the bank in accordance with the terms of the letter of credit within the terms specified in the text of the letter of credit.

is the obligation of the payer’s bank to make a payment to the beneficiary’s bank only after the payee has submitted certain documents to its bank, stipulated by the terms of the letter of credit.

Letters of credit refer to the so-called documentary operations of a bank, that is, to operations whose basis is document flow. Most often, documentary operations, in particular, letters of credit, are used by enterprises engaged in export-import activities, but this is not the only sphere of their application.

Why do you need letters of credit? — in order to eliminate fraud between the parties to a particular transaction. The bank simply acts as a legal guarantor between the parties to the transaction.

The most common areas of application of letters of credit:

• Export and import operations

• Trading operations within or between countries

• Large transactions between individuals (for example, buying and selling real estate)

Wherein:

Buyer saves on cash collection

Buyer saves on cash collection

The seller saves on checking and recounting bills.

The seller saves on checking and recounting bills.

After the end of the transaction, the seller can receive money in any branch of the bank. Without any fees.

When using a letter of credit, both parties win, because performance of obligations under the contract is guaranteed by the bank.

A letter of credit is essentially similar to settlement through a bank cell. The difference is that the mutual settlements for the transaction are made in a cashless way.

A cell is also considered a safe calculation. But we must remember that the bank is NOT RESPONSIBLE FOR THE CONTENT, and therefore, at the moment of depositing money into it, there is no checking of bills for authenticity, this should be done either in advance or the buyer should be checked for the word and the amount pledged in the cell. Also in the case of "force majeure", such as a fire or bank robbery, you are unlikely to be able to get your money back, because the bank is not responsible for the content. It only provides temporary storage.

Benefits:

Payment guarantee to the supplier

Payment guarantee to the supplier

Control over the fulfillment of the terms of delivery and the terms of the letter of credit by banks

Control over the fulfillment of the terms of delivery and the terms of the letter of credit by banks

Funds are not diverted from the economic turnover

Funds are not diverted from the economic turnover

Disadvantages:

Complex workflow;

Complex workflow;

High bank fees.

High bank fees.

Our company minimizes defects and does everything for its customers.

Our company minimizes defects and does everything for its customers.

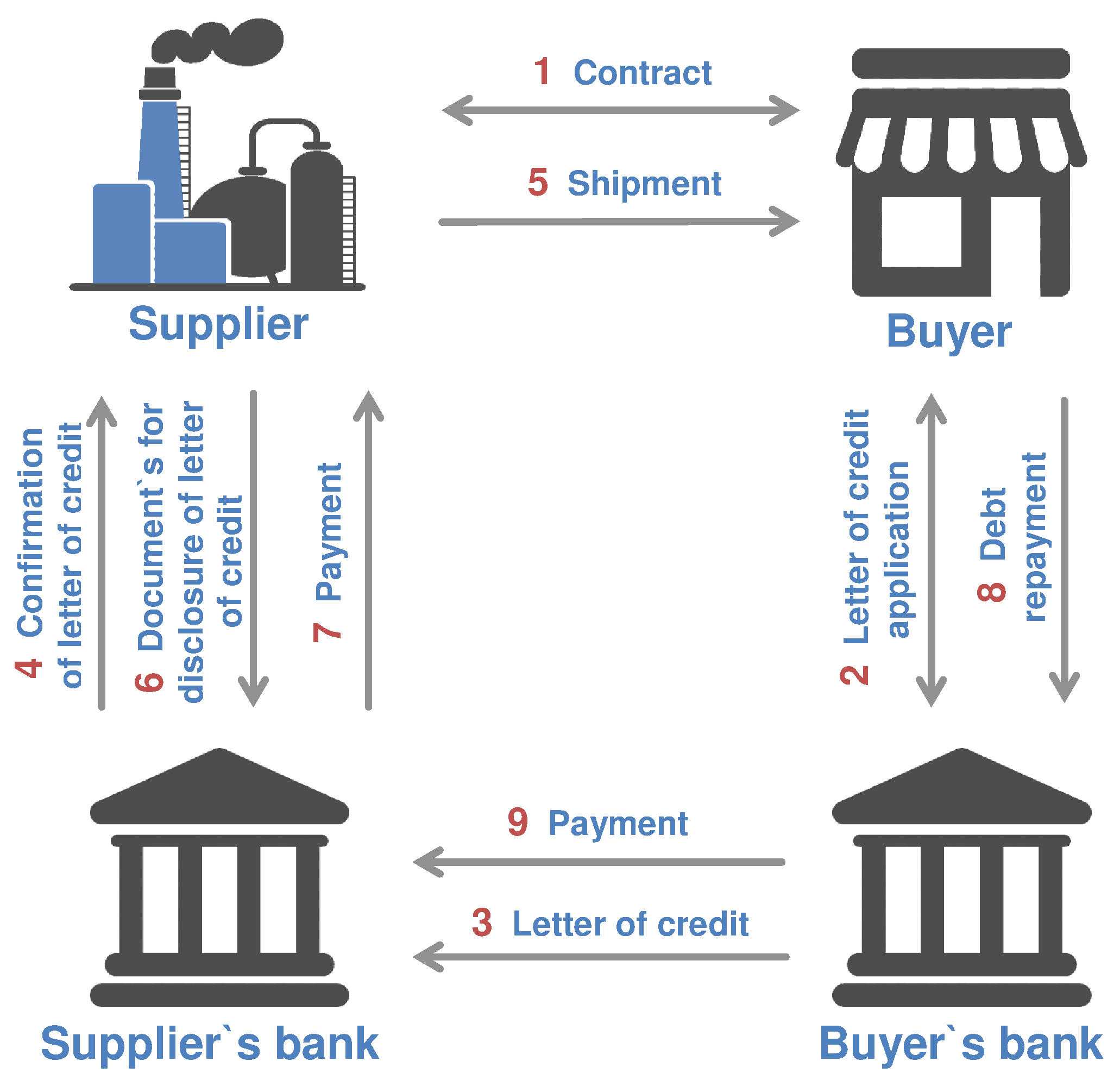

Consider the scheme of the letter of credit on the example. Suppose we have a supplier and a buyer of a certain product who do not trust each other and want to hedge. The buyer is afraid to send money without seeing the goods, and the supplier — to send the goods without seeing the money.

Opening a letter of credit can help in such a situation. The buyer opens a letter of credit at his bank, deposits the amount of the payment into a special account, and instructs him to send it to the supplier to his bank, but only after the supplier has provided documents confirming the fact of sending the goods.

The buyer's bank sends the letter of credit to the supplier’s bank, and the supplier’s bank informs the supplier itself. The supplier, knowing that the means to pay for the goods have already been reserved and will be sent to him, dispatches the goods and submits documents to his bank confirming this fact. The supplier's bank checks the legal purity of these documents and on the basis of this it makes the necessary payment, and reports it to the buyer's bank. After that, the buyer's bank transfers to the supplier’s bank the reserved funds of its client. The supplier receives his money, the buyer — the goods, and the banks — their commission. Everyone is happy. This is the classic scheme of a letter of credit, and depending on the type of service, some actions may vary.

For clarity, the approximate scheme of the letter of credit can be presented in the following figure (the numbers indicate the procedure):

A revocable letter of credit implies the possibility of the issuing bank to withdraw (cancel) its order to transfer funds until the opposite party submits the necessary documents, that is, to cancel the operation without notifying the receiving bank.

An irrevocable letter of credit does not imply the possibility of its cancellation without notifying the receiving bank and without the consent of the direct payee. That is, it can also be canceled, but only with the consent of the two parties, and not unilaterally as a revocable letter of credit.

Irrevocable letters of credit are used in practice much more often than revocable ones, since they are more suited to the interests of both parties to the transaction.

A confirmed letter of credit guarantees that the beneficiary’s bank or another third bank will pay the beneficiary the amount due, even if the sender’s bank does not transfer money to it.

An unconfirmed letter of credit assumes that the payment will be received by the recipient only if it is actually transferred by the issuing bank.

A covered (deposited) letter of credit means that the issuing bank transfers the amount of the payment to the beneficiary's bank for the entire term of the letter of credit. This amount is a guaranteed coverage, and is immediately at the disposal of the beneficiary's bank.

An uncovered (guaranteed) letter of credit means that the issuing bank allows the beneficiary bank to debit the payment amount from its correspondent account, or it stipulates some other conditions for receiving the refund. In practice, this type of letter of credit is most often used.

A letter of credit with a red clause means that the issuing bank undertakes to make the agreed amount of the advance payment to the beneficiary's bank even before the receipt of supporting documents from the beneficiary.

A revolving letter of credit is opened for regular identical financial transactions when necessary. It acts on a certain batch of goods each time and then resumes its effect on the next batch.

Transferable (transferable) letter of credit implies the possibility of transferring its part to another beneficiary, if necessary.

Standby letter of credit or stand-by letter of credit is a kind of symbiosis of a letter of credit and a bank guarantee, under which the supplier receives payment for the goods, even if the buyer refuses to pay him - the bank makes the payment at its own expense.

A bank letter of credit is a kind of guarantee of the legal purity of the transaction, removing virtually all the risks of fraud, because of the documents confirming the fact of the transfer of goods from the seller to the buyer are checked by experienced bank lawyers. Opening a letter of credit in the implementation of export-import transactions is also interesting because, regardless of the countries of the supplier and the buyer, such operations are governed by a universal document —international Uniform rules and customs for documentary letters of credit UCP-600, which eliminates the risks of inconsistency of laws of different countries. Opening a letter of credit will cost the buyer a certain amount, but this amount is significantly lower than, for example, when receiving a loan, and a letter of credit of a certain type includes many parameters of a credit transaction, but also ensures the safe conduct of the transaction. That is, it is quite a profitable service, but at the same time requiring an additional costs.

Due to our good faith, trust in the banking sector and impeccable reputation our company can act as a guarantee of your solvency to the bank. It is not at all required to transfer the entire required amount of money to our bank account for covering the letter of credit. We take the risk of covering the letter of credit for a small and flexible percentage of the amount of the letter of credit. Favorable conditions for work, security in conducting transactions will ensure you successful promotion of your business!

Liviera Investments Limited use many financial instruments to help you to achieve your economic goals.

We issue the following financial instruments:

LC — Letter of Credit

LC — Letter of Credit

DLC — Documentary Letter of Credit

DLC — Documentary Letter of Credit

SBLC — Standby Letter of Credit

SBLC — Standby Letter of Credit

BG — Bank Guarantee

BG — Bank Guarantee

LG — Letter of Guarantee

LG — Letter of Guarantee

POF — Proof of Funds

POF — Proof of Funds

POA — Proof of Assets

POA — Proof of Assets

POP — Proof of Product

POP — Proof of Product

Additional service:

Services in the SWIFT system

Services in the SWIFT system

Trade finance

Trade finance

Factoring

Factoring

Financial consulting

Financial consulting

Trade consulting

Trade consulting

IT consulting

IT consulting

Packing credit

Packing credit

Funding

Funding

Monetization

Monetization

We very actively work with the following countries:

China, India, United Arab Emirates, Indonesia, Malaysia, Greece, United States of America, Canada, Nigeria, Singapore, Uzbekistan, Kazakhstan, Afghanistan, Ukraine, Georgia, Romania, Ghana, South Africa, Turkey and other countries.

Our team promotes your goals and helps you achieve high results.

We, Liviera Investments Limited, are interested in your pursuit of a prosperous business and we are doing our best to make your efforts a success.

Our team will apply the maximum knowledge and experience so that your company develops and functions harmoniously. We are fundamentally different from other companies, because we know how to correctly use financial instruments to achieve your high results: a lot of our own running and functioning projects made it possible to study the process of successful business operation.

Philosophy

Our experts are well aware that any business consists of a huge number of nuances that need to be taken into account and approach every task thoroughly. Success guidelines do not exist, and our experts with professional skills will help you to achieve success soon. We find innovative solutions that we offer at your service!

Expert knowledge

We know that any business is accompanied by various difficulties, but we are here to help you every step of the way. Our specialists have gone through similar professional situations and can assist you in building an effective business process. We have a wealth of experience and knowledge and are experts in our work!

Our network:

Great Britain, France, Germany, Russia, China, New Zealand, India, United Arab Emirates, Indonesia, Malaysia, Greece, USA, Canada, Singapore, Belgium, Uzbekistan, Kazakhstan, Afghanistan, Ukraine, Georgia, Romania, Ghana, South Africa, Turkey, Slovakia , Bulgaria, Hungary.

Liviera Investments Limited is your financial partner for all your trade finance projects.