Volume of transactions

Amount of deals

Clients

Countries

A bank guarantee is one of the ways to ensure fulfillment of obligations, in which a bank or other credit institution (guarantor) issues, at the request of the debtor (principal), a written obligation to pay a sum of money when it is required to pay it to the creditor (beneficiary) according to the terms of the agreement, loan third party debt security if that party fails to fulfill its obligations.

In other words, a bank guarantee is an obligation of a bank or other credit institution to pay a certain amount of money to a lender in case of violation of an agreement on a contract by a supplier (contractor, performer). The payment is made on the conditions specified in the guarantee document, which is drawn up in writing on the letterhead and stamped with the official stamp.

According to the bank guarantee, the bank / guarantor undertakes to repay the possible debt of the debtor company to the creditor at the request of the creditor upon the occurrence of specifically defined conditions.

At the same time, the bank / guarantor undertakes to pay the lender an exact, predetermined amount.

The peculiarity of such an agreement is that at the time of issuing a bank guarantee, the company’s obligation to the creditor itself does not yet exist, that is, the creditor is potential.

Indebtedness for the purchased goods, works or services may not arise.

Our specialists will professionally assist you, advise you on the issues you have, acquaint you with the unique products of our company, select the best package of services for the needs of your business.

When bank guarantees are needed: types of guarantees

• Warranty obligations is a fairly common form of security transactions, used in many market segments. Depending on the ultimate goal of the recipient in practice, we can offer several types of guarantees, for example:

• Tender. Mandatory security applied in the procurement procedure and guaranteeing compliance with the conditions of the tender / tender by the participant, as well as further fulfillment of his obligations. As a rule, tender obligations consist in signing a standard contract and providing a guarantee of contract performance (usually set at 1%-5% of the contract amount).

• Billing. Relevant in the field of commodity credit, as well as to obtain installment payments from the supplier. Guarantees payment for products in full, in case of delay or debt on the part of the debtor.

• Customs. Used in the process of customs clearance of goods and their documentation when crossing the state border. Such a guarantee is paid to the customs (tax) authorities in the cases established by the legislation of this or that state.

• Fulfillment. Ensures proper execution of the transaction by the executor. Payments from the bank are due to the customer and are made in the event of default by the counterpart under the contract. Exhibited, as a rule, 5%-20% of the contract amount.

• Refund of payment / advance. The bank reimburses the beneficiary the amount of the unpaid advance payment transferred to it by the buyer under the terms of the contract.

• Loan repayment. The recipient of the guarantee payment is the lender who issued the borrowed funds.

The bank guarantee is a serious support for business in various spheres of economic activity. In fact, a well-executed guarantee performs the function of an insurance policy for the lender and a credential certifying good faith and solvency for the borrower.

For our clients, we issue guarantees — an independent obligation towards the beneficiary to pay a certain amount against the written claim of the beneficiary’s benefits with a statement of non-fulfillment by the beneficiary’s counter partner of its obligations under the contract.

As in the case of a letter of credit, a bank guarantee is a bank's obligation to pay against the submission of documents, independent of the contract, but the essence of the guarantee is to ensure the fulfillment of obligations, i.e. the guarantee payment takes place in the event of non-fulfillment of contractual obligations.

Since the guarantee is an instrument completely independent of the contract, the bank that received the guarantee requirement is obliged to make the payment regardless of the actual state of affairs with the applicant’s performance of its obligations.

As a rule, guarantees are issued for a period of 1 (one) year and 1 (one) month. Our Bank Guarantee will be issued on SWIFT MT760.

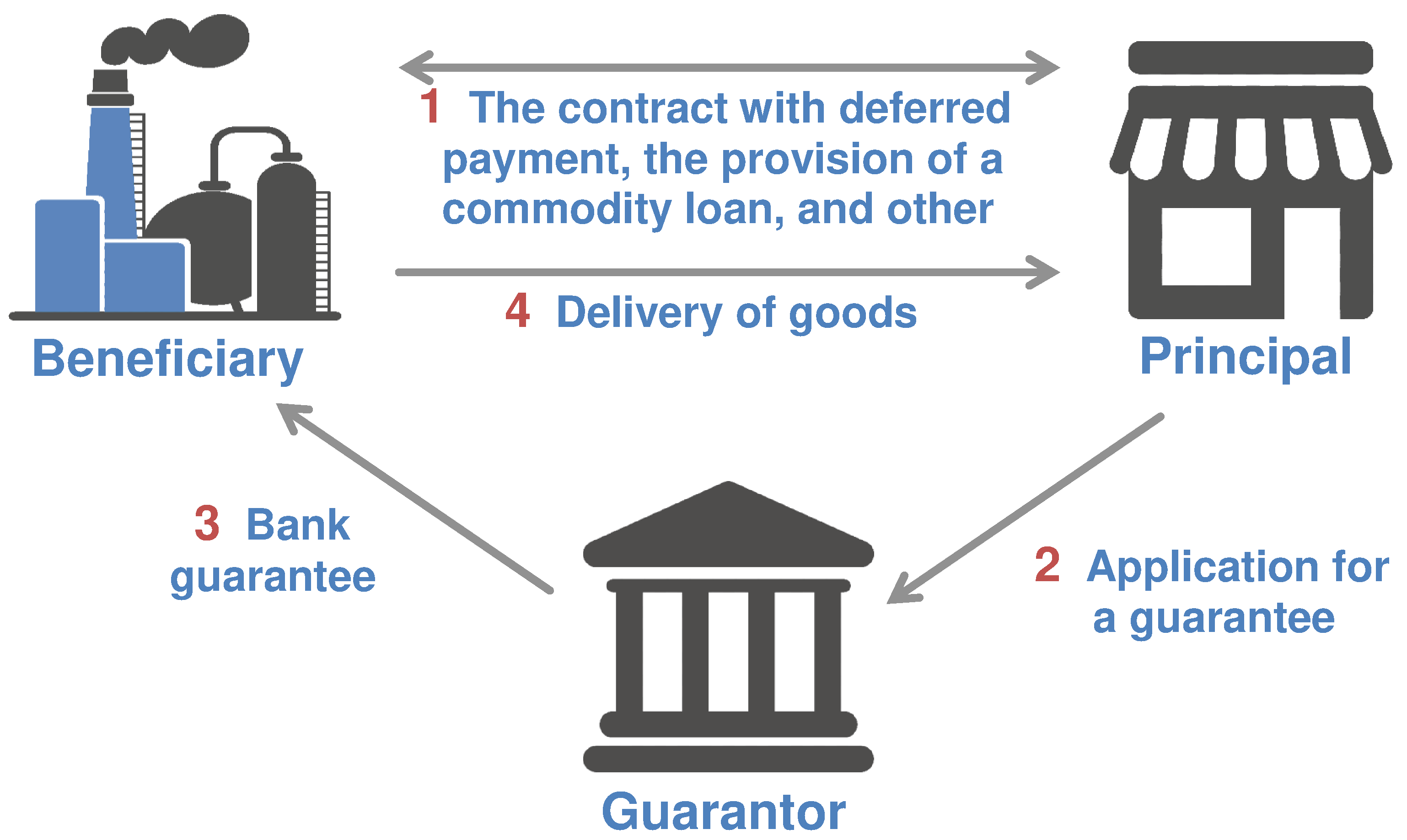

Parties warranty

The guarantee agreement is concluded between two participants — the borrower (principal) and the bank (guarantor) in favor of the third participant — the lender (beneficiary). The borrower usually acts as the performer (contractor) or buyer (acquirer) of the transaction.

In the role of the guarantor may be a banking or other credit institution, as well as commercial organizations.

Long-term practice of work in this area allows us to assert that bank guarantees are much more profitable and easier to use than other interim measures, including a guarantee and a pledge.

Advantages of a bank guarantee:

1. It is cheaper — of course, if you approach it carefully, using the services of our company.

2. Does not require withdrawal of money from circulation, as in the case of registration of a pledge. Borrowed funds will cost even more — the interest on loans is usually higher than the bank guarantee commission.

3. It is not related to the history of the main transaction — in fact, it is unchanged during the entire term of validity, unless the parties have agreed other conditions, whereas the guarantee is directly dependent on the fate of the secured obligation.

4. In some cases, it is the only possible means of security.

5. A reliable interim measure providing the recipient with great opportunities in the market, including the right to a commodity loan and deferred payment.

For the lender, such collateral is a proven legitimate way to reduce its own risks and at the same time verify the financial position of the proposed counterpart. Thus, an independent guarantee performs the role of a kind of certificate confirming the solvency and economic stability of the borrowing company.

How much a bank guarantee will cost you depends on several significant factors:

1. The sum of the main contract and the subject of the secured obligation.

2. The size of the guarantee payment claimed by the borrower or the statutory amount of payments.

3. The term of the bank guarantee during which the beneficiary can receive the due amount according to the contract.

4. The presence (or absence) of liquid collateral, with which the bank reduces its own risks.

The cost of the guarantee is the base value for calculating the commission paid to the bank on the day of the documentation. In practice, the remuneration of the guarantor ranges from 2% to 10% or is a fixed amount with a lower minimum threshold, calculated in currency equivalent.

Affordable and convenient service, high speed of decision making, confidentiality and cost-effectiveness are not the main advantages of our company.

We would like to pay special attention to the fact that we are not going against the wishes of our partners, we contribute to the competent implementation of their projects!

Liviera Investments Limited use many financial instruments to help you to achieve your economic goals.

We issue the following financial instruments:

LC — Letter of Credit

LC — Letter of Credit

DLC — Documentary Letter of Credit

DLC — Documentary Letter of Credit

SBLC — Standby Letter of Credit

SBLC — Standby Letter of Credit

BG — Bank Guarantee

BG — Bank Guarantee

LG — Letter of Guarantee

LG — Letter of Guarantee

POF — Proof of Funds

POF — Proof of Funds

POA — Proof of Assets

POA — Proof of Assets

POP — Proof of Product

POP — Proof of Product

Additional service:

Services in the SWIFT system

Services in the SWIFT system

Trade finance

Trade finance

Factoring

Factoring

Financial consulting

Financial consulting

Trade consulting

Trade consulting

IT consulting

IT consulting

Packing credit

Packing credit

Funding

Funding

Monetization

Monetization

We very actively work with the following countries:

China, India, United Arab Emirates, Indonesia, Malaysia, Greece, United States of America, Canada, Nigeria, Singapore, Uzbekistan, Kazakhstan, Afghanistan, Ukraine, Georgia, Romania, Ghana, South Africa, Turkey and other countries.

Our team promotes your goals and helps you achieve high results.

We, Liviera Investments Limited, are interested in your pursuit of a prosperous business and we are doing our best to make your efforts a success.

Our team will apply the maximum knowledge and experience so that your company develops and functions harmoniously. We are fundamentally different from other companies, because we know how to correctly use financial instruments to achieve your high results: a lot of our own running and functioning projects made it possible to study the process of successful business operation.

Philosophy

Our experts are well aware that any business consists of a huge number of nuances that need to be taken into account and approach every task thoroughly. Success guidelines do not exist, and our experts with professional skills will help you to achieve success soon. We find innovative solutions that we offer at your service!

Expert knowledge

We know that any business is accompanied by various difficulties, but we are here to help you every step of the way. Our specialists have gone through similar professional situations and can assist you in building an effective business process. We have a wealth of experience and knowledge and are experts in our work!

Our network:

Great Britain, France, Germany, Russia, China, New Zealand, India, United Arab Emirates, Indonesia, Malaysia, Greece, USA, Canada, Singapore, Belgium, Uzbekistan, Kazakhstan, Afghanistan, Ukraine, Georgia, Romania, Ghana, South Africa, Turkey, Slovakia , Bulgaria, Hungary.

Liviera Investments Limited is your financial partner for all your trade finance projects.