Volume of transactions

Amount of deals

Clients

Countries

Packing credit plays a huge role for the development and success of both small and larger manufacturing companies. In addition to favorable terms of use of this financial instrument, there are many undisputable advantages.

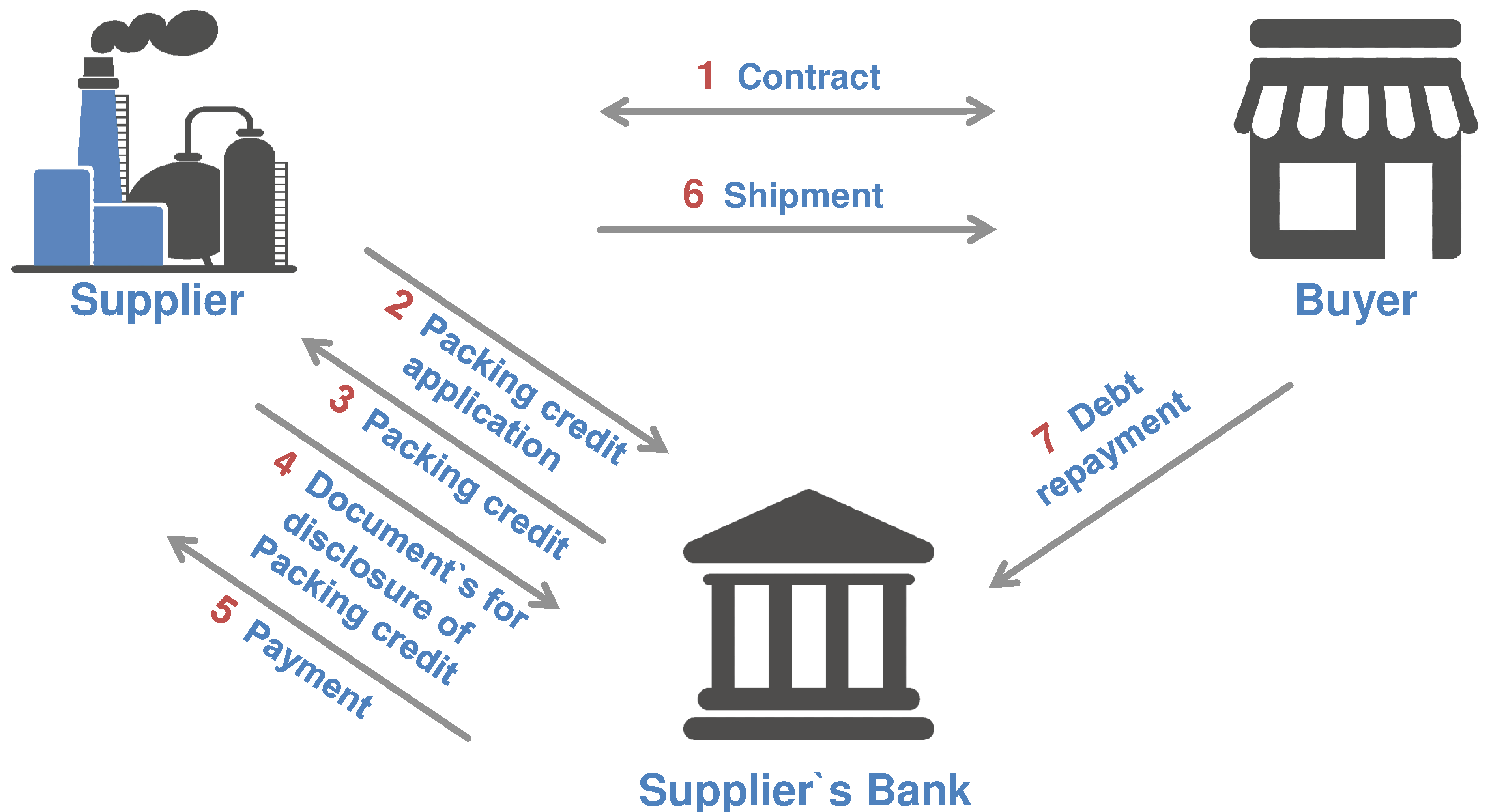

for the purpose of the company, which consists in the uninterrupted production of products, their packaging and subsequent transportation to the final buyer. Packing credit is often necessary until the exporting company fulfills its full obligations under the contract with the buyer. As soon as the moment of delivery of the last batch of products to the buyer, the final settlement between the parties to the contract takes place. Packing credit all this time “did” its work and supported the exporter’s entire supply chain to overcome unforeseen financial difficulties and gaps in the supply of products until the day of final settlement under an agreement with the buyer. A bank issuing Packing credit can provide an advance in the form of small parts as well as the full amount required for the purposes of the company. The size of advance payments depends on the perceived risk and the bank’s decision on the size of this advance payment is made individually.

Packing credit is convenient and has very flexible repayment terms of borrowed funds; it is really better and more profitable than a classic bank loan. Packing credit can be provided both in the national currency of the exporting company and in another easily convertible currency by mutual decision of both the exporting company and the creditor bank.

Banks and other credit institutions are required to conduct an internal audit of the company applying for this type of financial instrument. Not only the pure intentions of the company itself are checked, but the agreement between the buyer and the seller is checked, the purchase order or the letter of credit is checked to confirm the authenticity of the transaction. But, be sure to keep in mind that the documentation associated with this type of financial instrument and the direct issuance of a loan by a financial institution are not very complicated and not very costly. In addition, the time spent on obtaining this type of advance payment is much less than you would have spent on getting a regular loan in a bank.

1. Packing credit has a main feature, it is self-liquidating.

This means that a loan can be liquidated as a final payment for goods and services, or it can even be converted into financial assets after the final shipment of goods to the buyer. This is extremely beneficial for small exporters who may not have the necessary capital. This fact also eliminates a big risk in financing, since the bank has a guarantee of payment before the exporter receives the proceeds.

2. Packing credit is convenient to use for the purchase of expensive goods and raw materials, even if they are several times higher than the established budget of the manufacturer.

3. A preliminary loan can cover all current production costs, including salaries for hired workers, utility payments, repair of production equipment, payment for the cost of raw materials, and so on. This is especially beneficial if the exporter has outsourced part of the goods or the entire shipped goods.

4. Pleasant low interest rate compared to regular overdraft. Most banks do not have a single interest rate for using this financial instrument, since the percentage depends on the nature of the business, the loan amount, the amount of risk, and so on. However, the percentage of pre-loan will always be lower than that of a classic bank loan.

5. Flexible lending conditions! Banks often allow the exporter to repay the loan after receiving the final payment under the contract. If necessary, the bank can continue to finance all intermediate needs of the exporter.

Packing credit is a reliable and convenient financial tool. Instead of emptying their own liquid reserves, banks and other lending institutions can provide a fairly profitable and convenient way to finance the business of any company at all stages of production!

Liviera Investments Limited use many financial instruments to help you to achieve your economic goals.

We issue the following financial instruments:

LC — Letter of Credit

LC — Letter of Credit

DLC — Documentary Letter of Credit

DLC — Documentary Letter of Credit

SBLC — Standby Letter of Credit

SBLC — Standby Letter of Credit

BG — Bank Guarantee

BG — Bank Guarantee

LG — Letter of Guarantee

LG — Letter of Guarantee

POF — Proof of Funds

POF — Proof of Funds

POA — Proof of Assets

POA — Proof of Assets

POP — Proof of Product

POP — Proof of Product

Additional service:

Services in the SWIFT system

Services in the SWIFT system

Trade finance

Trade finance

Factoring

Factoring

Financial consulting

Financial consulting

Trade consulting

Trade consulting

IT consulting

IT consulting

Packing credit

Packing credit

Funding

Funding

Monetization

Monetization

We very actively work with the following countries:

China, India, United Arab Emirates, Indonesia, Malaysia, Greece, United States of America, Canada, Nigeria, Singapore, Uzbekistan, Kazakhstan, Afghanistan, Ukraine, Georgia, Romania, Ghana, South Africa, Turkey and other countries.

Our team promotes your goals and helps you achieve high results.

We, Liviera Investments Limited, are interested in your pursuit of a prosperous business and we are doing our best to make your efforts a success.

Our team will apply the maximum knowledge and experience so that your company develops and functions harmoniously. We are fundamentally different from other companies, because we know how to correctly use financial instruments to achieve your high results: a lot of our own running and functioning projects made it possible to study the process of successful business operation.

Philosophy

Our experts are well aware that any business consists of a huge number of nuances that need to be taken into account and approach every task thoroughly. Success guidelines do not exist, and our experts with professional skills will help you to achieve success soon. We find innovative solutions that we offer at your service!

Expert knowledge

We know that any business is accompanied by various difficulties, but we are here to help you every step of the way. Our specialists have gone through similar professional situations and can assist you in building an effective business process. We have a wealth of experience and knowledge and are experts in our work!

Our network:

Great Britain, France, Germany, Russia, China, New Zealand, India, United Arab Emirates, Indonesia, Malaysia, Greece, USA, Canada, Singapore, Belgium, Uzbekistan, Kazakhstan, Afghanistan, Ukraine, Georgia, Romania, Ghana, South Africa, Turkey, Slovakia , Bulgaria, Hungary.

Liviera Investments Limited is your financial partner for all your trade finance projects.