Volume of transactions

Amount of deals

Clients

Countries

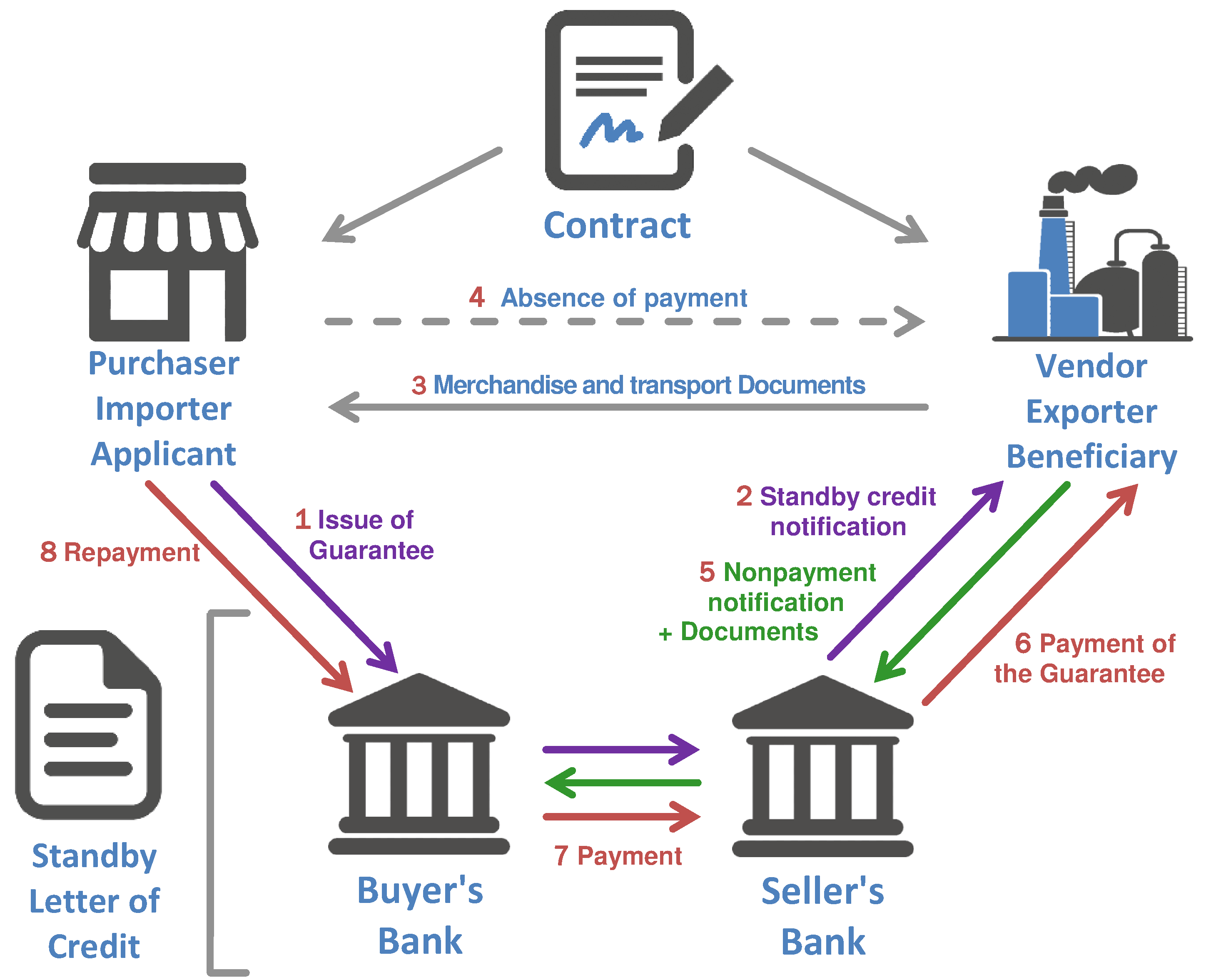

Standby Letter of Credit is a form of letter of credit, which is a written agreement of a banking organization on a payment transaction to a seller instead of a buyer, provided that the buyer refuses to fulfill the condition of the previously concluded contract.

is characterized by fairly frequent delays in payment transactions or requests to delay them. Provided that the agents already have a strong relationship with the buyer and trust him, they freely implement the delivery of goods without the need to issue guarantees through a banking organization.

But if the organization is suspicious of the real ability to pay at the cost of the goods ordered, it has the full right to request payment protection upon delivery as a guarantee from the bank.

The services we provide are unique tool in the development of international trade and mutually beneficial cooperation in a large-scale globalization of the economies of the world. Our experts will advise on all the issues and help to avoid many financial problems.

is the protection of the payment for the supplier after the moment all the conditions on their part specified in the agreement are fulfilled. If the supplier has already implemented the delivery of goods and is able to provide documents confirming this operation, the banking organization pays him a specific amount of money. This amount may be previously “fixed” in its bank account, or it may be credit money.

The Standby Letter of Credit is a form of bank protection, issued in accordance with the established requirements of the International Chamber of Commerce. This type of letter of credit is used to create trade relations with states where it is prohibited to use the protection of a banking organization when entering into agreements, as well as when dealing with companies of international level.

You can also say that the Standby Letter of Credit is the obligation of the banking organization, which is the issuer, to transfer the necessary funds to the supplier, provided that the buyer is not able to fulfill his payment obligation specified in the previously concluded contract. The payment will be realized even if the status of the buyer changes to “insolvent”.

The main condition for agreeing an agreement at the international level on the organization of the delivery of goods will be the fact of confirmation of the buyer’s ability to pay for the ordered goods. Domestic and foreign banking organizations in these conditions create an application for the usual bank guarantee and implement it.

The Standby Letter of Credit and the guarantee of a banking organization applied internationally are of interchangeable nature. These two documents are a guaranteed way of proving the financial stability of the customer and confirming his ability to pay for the order.

A letter of credit can be used in trade agreements of several states, as well as being an “assistant” for an organization that has decided to increase its own business for the subsequent exit to the international trade arena. A letter of credit at any time can be rewritten to any other supplier after completing an application from the previous one, but it is no longer possible to change this decision after passing the application through the SWIFT program.

The Standby Letter of Credit has its own principle of operation, which is that:

• The supplier and the seller made an agreement where the latter is obliged to deliver the goods. The seller has the right to request from the customer a guarantee of payment for the goods as a guarantee of a banking organization or a letter of credit. In case of non-payment of goods by the buyer on time, then this manipulation will be made for him by the bank through which the letter of credit was created;

• According to the concluded transaction, the seller has the right to shipment of goods only when the advance payment was received from the buyer. Here, the customer also has the right to demand a special order guarantor, which is characterized by the fact that the ordered goods must arrive at a specified time interval and of appropriate quality. Here the Standby Letter of Credit will be used as a guarantee of the seller’s obligations to the buyer.

In these two cases, the seller shifts all responsibility for possible risk situations in the process of delivering the goods to the banking organization where the letter of credit was opened. It is an open letter of credit that serves as a guarantor for the protection of all actions of the seller.

In the international arena, the Convention on Independent Guarantees and Stand-by Letters of Credit exists and is constantly applied, as well as various rules that are directed towards documentary letters of credit under the agreed ICC UCP 500 and ISP 98 numbers.

This documentation is kept in the archives of the International Chamber of Commerce. According to the existing rules that are described in this documentation, many controversial and conflict issues relating to the stand-by letter of credit and all forms of letter of credit as a whole can be resolved.

In the process of issuing a Stand-by Letter of Credit, the banking organization asks for the documents required by the accepted rules. This item helps to achieve the necessary level of protection of each of the parties in the conclusion of an agreement. A letter of credit is a guarantee “just in case”, which is launched only in the event of the buyer's inability to pay for the ordered goods.

The Stand-by Letter of Credit, as well as any other form of letter of credit, has several distinctive features:

1. The obligation of the banking organization on the implementation of the payment transaction in case of the inability of the buyer;

2. The guarantor of the transfer of funds to the supplier in the prescribed amount specified in the contract;

3. The ability to cover the entire period of the agreement with a single document;

4. This letter of credit indicates the ability of its implementation for different types of payments;

5. Opens exclusively with the submitted application;

6. Subject to the laws of international class UCP.

We should note that the SBLC and bank guarantee are very similar in application and use. But there are several positions where they differ:

• The Stand By Letter of Credit is applied when the customer fails to fulfill his obligations, which are specified in the agreement, and a simple letter of credit is characterized by payment only with a thorough check of all documentation on the shipment and delivery of goods;

• A letter of credit is an additional protection of the arrangement, according to which a guarantee is given that payment for the goods will be received by the supplier, and the buyer will be able to receive his own money if the agreement is violated. SBLC is the most common and universal form in the implementation process, in contrast to the usual letter of credit;

• The time of SBLC is not regulated in any way and is not controlled by national laws - this fact provides a greater percentage of reliability in the work in the international arena.

The process of implementing a Stand-by Letter of Credit is always prescribed in the contract. The banking organization of the buyer is engaged in registration in favor of the seller’s banking organization. If the parties to the agreement have fulfilled all the specified conditions in time, then the need to use and apply the stand-by letter of credit is canceled. But, if a violation was noticed for any of the parties, then a letter of credit takes effect, which is aimed at resolving sensitive issues regarding payment for the goods.

In the case when the buyer could not pay for his goods, the seller must bring a statement to the banking organization stating that the necessary funds were not received into his account from the buyer. In addition, he must bring to the bank a document and a copy of it, where it is indicated that the goods ordered by the buyer arrived in the country of destination in the specified quantity and of appropriate quality.

A banking organization transfers funds to the seller’s account without informing of the buyer. After that, the bank organization is reimbursed the payment made. Thus, an unconditional payment is realized. In most cases, this document is used in overseas deliveries, which is also used in any other arrangements for the purchase or sale of goods or services.

It is worth noting that the process of repayment of a Stand-by Letter of Credit occurs much less frequently than the usual letter of credit. It is most often used in the financial sector, and not in the implementation of trade operations. There are cases when the Standby Letter of Credit was applied with the cooperation of several banking organizations.

Payment from the importer is faster because once documents have reached the airport or port, only 3-7 days are required to review the documents and finalize the acceptance of the goods.

Banks send this SBLC back and forth through SWIFT MT799 and then SWIFT MT760.

Affordable and convenient service, high decision-making speed, reliability and individual approach are the few advantages of our company. We will be glad to cooperate!

Liviera Investments Limited use many financial instruments to help you to achieve your economic goals.

We issue the following financial instruments:

LC — Letter of Credit

LC — Letter of Credit

DLC — Documentary Letter of Credit

DLC — Documentary Letter of Credit

SBLC — Standby Letter of Credit

SBLC — Standby Letter of Credit

BG — Bank Guarantee

BG — Bank Guarantee

LG — Letter of Guarantee

LG — Letter of Guarantee

POF — Proof of Funds

POF — Proof of Funds

POA — Proof of Assets

POA — Proof of Assets

POP — Proof of Product

POP — Proof of Product

Additional service:

Services in the SWIFT system

Services in the SWIFT system

Trade finance

Trade finance

Factoring

Factoring

Financial consulting

Financial consulting

Trade consulting

Trade consulting

IT consulting

IT consulting

Packing credit

Packing credit

Funding

Funding

Monetization

Monetization

We very actively work with the following countries:

China, India, United Arab Emirates, Indonesia, Malaysia, Greece, United States of America, Canada, Nigeria, Singapore, Uzbekistan, Kazakhstan, Afghanistan, Ukraine, Georgia, Romania, Ghana, South Africa, Turkey and other countries.

Our team promotes your goals and helps you achieve high results.

We, Liviera Investments Limited, are interested in your pursuit of a prosperous business and we are doing our best to make your efforts a success.

Our team will apply the maximum knowledge and experience so that your company develops and functions harmoniously. We are fundamentally different from other companies, because we know how to correctly use financial instruments to achieve your high results: a lot of our own running and functioning projects made it possible to study the process of successful business operation.

Philosophy

Our experts are well aware that any business consists of a huge number of nuances that need to be taken into account and approach every task thoroughly. Success guidelines do not exist, and our experts with professional skills will help you to achieve success soon. We find innovative solutions that we offer at your service!

Expert knowledge

We know that any business is accompanied by various difficulties, but we are here to help you every step of the way. Our specialists have gone through similar professional situations and can assist you in building an effective business process. We have a wealth of experience and knowledge and are experts in our work!

Our network:

Great Britain, France, Germany, Russia, China, New Zealand, India, United Arab Emirates, Indonesia, Malaysia, Greece, USA, Canada, Singapore, Belgium, Uzbekistan, Kazakhstan, Afghanistan, Ukraine, Georgia, Romania, Ghana, South Africa, Turkey, Slovakia , Bulgaria, Hungary.

Liviera Investments Limited is your financial partner for all your trade finance projects.