Volume of transactions

Amount of deals

Clients

Countries

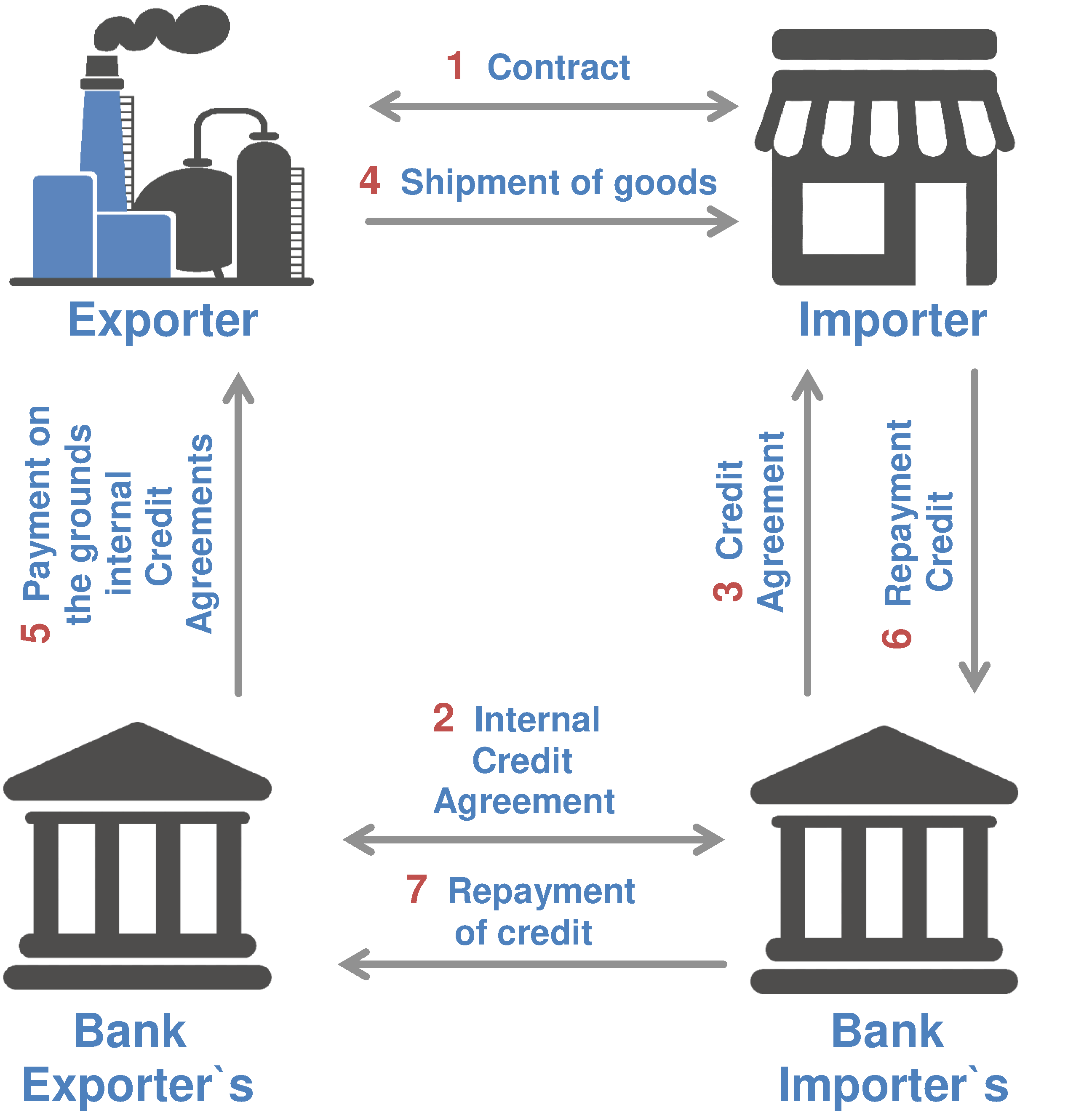

Our clients benefit from trade finance in foreign trade operations. We help organize work in this area of activity of companies engaged in export-import activities.

is an effective and extremely useful mechanism for the development of foreign trade activities of our clients; This is the financing of foreign trade operations under the concluded contracts using various financial instruments, this includes documentary instruments too (including letters of credit).

obtain cost-effective financing in the amount of up to 100% of the amount of the concluded contract,

obtain cost-effective financing in the amount of up to 100% of the amount of the concluded contract,

to minimize their own financial risks and the risks of a foreign partner from non-payment and non-delivery of goods or services,

to minimize their own financial risks and the risks of a foreign partner from non-payment and non-delivery of goods or services,

as well as maximally optimize trade operations with foreign partners using documentary forms of payment.

as well as maximally optimize trade operations with foreign partners using documentary forms of payment.

Trade finance is advantageous due to its low cost compared to conventional bank lending. At the same time, the risk associated with conducting foreign trade transactions is reduced, since the money transfer is made by the bank after receipt and verification of shipping documents by the seller.

Trade finance is advantageous due to its low cost compared to conventional bank lending. At the same time, the risk associated with conducting foreign trade transactions is reduced, since the money transfer is made by the bank after receipt and verification of shipping documents by the seller.

Trade financing of the transaction for the importer allows you to receive a deferment of payment for the goods or services delivered for a longer period than the periods for which it is possible to obtain a loan. In this case, the exporter receives the funds due to him immediately after the presentation of the shipping documents to the bank.

Trade financing of the transaction for the importer allows you to receive a deferment of payment for the goods or services delivered for a longer period than the periods for which it is possible to obtain a loan. In this case, the exporter receives the funds due to him immediately after the presentation of the shipping documents to the bank.

Trade financing allows an enterprise not to divert its own working capital: when opening a letter of credit or issuing a guarantee, the client does not reserve money, but provides the bank with a guarantee of fulfillment of obligations, for example, followed by accepting imported equipment as a pledge.

Trade financing allows an enterprise not to divert its own working capital: when opening a letter of credit or issuing a guarantee, the client does not reserve money, but provides the bank with a guarantee of fulfillment of obligations, for example, followed by accepting imported equipment as a pledge.

The use of a letter of credit allows the client to refuse a prepayment in favor of the seller.

The use of a letter of credit allows the client to refuse a prepayment in favor of the seller.

Benefits for the Importer:

● It is possible to receive credit funds, the cost of which is significantly lower than that of a traditional bank loan. This is possible due to the attraction of more profitable and cheaper credit resources from other foreign financial institutions.

● It is possible to significantly increase the volume of purchased products and business development in general.

● Significant savings in working capital of the company.

● Possibility to increase the term of financing in the case of acquisition of capital goods.

● Other advantages of the financial instruments involved.

Benefits for Exporter:

● It is possible to receive credit funds, the cost of which is significantly lower than that of a traditional bank loan. This is possible due to the attraction of more profitable and cheaper credit resources from other foreign financial institutions.

● Significant savings in working capital of the company.

● It is possible to repay the existing loan with funds from export earnings.

● Strengthening competitive position in the market.

● Other advantages of the financial instruments involved.

For Importer:

Documentary letter of credit with subsequent financing of up to 2 years

Deferred documentary letter of credit

Financing within credit lines from 3 to 10 years

Forfaiting (promissory notes)

Financing under the coverage of Export Credit Agencies (ECA) and Eximbanks

For Exporter:

Pre export financing under credit lines

Financing conditions:

Purpose: financing the purchase of capital goods (machinery, equipment, machinery, spare parts and other fixed assets) and related services (Note: in some cases it is possible to finance consumer goods and other types of goods.)

Financed contract amount: up to 100% of the contract amount

Minimum loan amount: from 50,000.00 Euro / USD

Currency: USD or Euro

The cost of a commission for issuing a financial instrument for each client is considered individually; its size depends on the category of the bank and the nominal value of the financial instrument.

The client has the opportunity to pay the supplier's bank after the goods are sold on time by installments.

Liviera Investments Limited use many financial instruments to help you to achieve your economic goals.

We issue the following financial instruments:

LC — Letter of Credit

LC — Letter of Credit

DLC — Documentary Letter of Credit

DLC — Documentary Letter of Credit

SBLC — Standby Letter of Credit

SBLC — Standby Letter of Credit

BG — Bank Guarantee

BG — Bank Guarantee

LG — Letter of Guarantee

LG — Letter of Guarantee

POF — Proof of Funds

POF — Proof of Funds

POA — Proof of Assets

POA — Proof of Assets

POP — Proof of Product

POP — Proof of Product

Additional service:

Services in the SWIFT system

Services in the SWIFT system

Trade finance

Trade finance

Factoring

Factoring

Financial consulting

Financial consulting

Trade consulting

Trade consulting

IT consulting

IT consulting

Packing credit

Packing credit

Funding

Funding

Monetization

Monetization

We very actively work with the following countries:

China, India, United Arab Emirates, Indonesia, Malaysia, Greece, United States of America, Canada, Nigeria, Singapore, Uzbekistan, Kazakhstan, Afghanistan, Ukraine, Georgia, Romania, Ghana, South Africa, Turkey and other countries.

Our team promotes your goals and helps you achieve high results.

We, Liviera Investments Limited, are interested in your pursuit of a prosperous business and we are doing our best to make your efforts a success.

Our team will apply the maximum knowledge and experience so that your company develops and functions harmoniously. We are fundamentally different from other companies, because we know how to correctly use financial instruments to achieve your high results: a lot of our own running and functioning projects made it possible to study the process of successful business operation.

Philosophy

Our experts are well aware that any business consists of a huge number of nuances that need to be taken into account and approach every task thoroughly. Success guidelines do not exist, and our experts with professional skills will help you to achieve success soon. We find innovative solutions that we offer at your service!

Expert knowledge

We know that any business is accompanied by various difficulties, but we are here to help you every step of the way. Our specialists have gone through similar professional situations and can assist you in building an effective business process. We have a wealth of experience and knowledge and are experts in our work!

Our network:

Great Britain, France, Germany, Russia, China, New Zealand, India, United Arab Emirates, Indonesia, Malaysia, Greece, USA, Canada, Singapore, Belgium, Uzbekistan, Kazakhstan, Afghanistan, Ukraine, Georgia, Romania, Ghana, South Africa, Turkey, Slovakia , Bulgaria, Hungary.

Liviera Investments Limited is your financial partner for all your trade finance projects.